SWENSETH LAW

|

A comprehensive estate plan should include a Durable Power of Attorney, a Health Care Directive, and a blanket HIPAA release. HIPAA, the Health Insurance Portability and Accountability Act of 1996 created the health information privacy requirements for providers of health care services. HIPAA's privacy rules prohibit health care providers from sharing patients' private health information with anyone whom the patient has not authorized to receive such information.

A Health Care Directive appoints an Agent, and often alternative agents, to make decisions for the Principal. The Principal is the person granting the decision-making powers to an Agent. The Agent appointed in the Health Care Directive is generally considered to be authorized to receive the principal's private health information when the Principal is deemed not able to handle his/her own affairs. That makes sense. We wouldn't want your Agent making decisions without knowing the Principal's health care situation. That would be dangerous. Some people believe that the Agent doesn't have the right to receive the Principal's private health information until the Principal cannot speak for himself/herself. What would happen if the Principal is unable to speak for himself/herself because of a car accident or for some other sudden reason? That Principal needs health care decisions made in an emergency. Of course, emergency medical providers will provide the medical care necessary to deal with the emergency, but if the Principal has some non-obvious medical condition that the emergency personnel need to know? If the agent has not been able to receive the Principal's health information, then no one might be able to warn the emergency personnel about the Principal's condition. Your Agent might not be available in an emergency situation because the emergency personnel will probably not be able to look for the Agent (or even a Health Care Directive) while trying to attend to the Principal's emergency. Health care professionals won't withhold emergency treatment while looking for the Agent. That said, in the aftermath of the emergency, medical providers will want permission from the Principal or the Agent to provide follow-up care. This follow-up care will not be "emergency," but it may be pressing. Because of whatever created the need for emergency care (like a fall, an accident, or a stroke, for example,) the Principal may not be able to make a decision or may not be able to communicate his/her decision on health care matters. As a result, the Agent may need to make these decisions and, in some circumstances, may need to make these health care decisions quickly. When time is of the essence in a health care setting, the Principal's care should not be put on hold while the Agent learns for the first time about the Principal's potentially complicated health conditions. Think ahead about the possibility of such an emergency. Would you prefer to create a broad HIPAA release to allow the sharing of health information to your Agent and the alternative agents named in the Health Care Directive? It may be important to include additional family members, or close friends, that might be involved with and assisting the Agent at the time the Principal needs care.

2 Comments

Clio Connect is essentially designed to offer us the ability to provide you with a secure portal through which you can access specific resources, such as Documents, Tasks, Calendar Events and Invoices, that have been shared with you. Additionally, messages shared via Clio Connect are more secure than messages sent to a work email, that your employer may access and read, or a free email provider like gmail, hotmail, or yahoo.

Clio Connect also enables us to easily share resources and collaborate with clients, contacts, or co-counsels through a secure web-based portal. This gives our clients and related contacts, the ability to access, review, and contribute to relevant matter developments and mitigate associated inefficiencies related to time consuming communications. For more information on what can be done using Clio Connect, please click on this link for Clio articles, broken down by topic. For several years now Gun Trusts have gained in popularity, largely with firearms enthusiasts. With an ever increasing number of federal and state gun laws, many of which are unique and sometimes conflicting, and and an estimated 300 million firearms in the United States, it is certain that a firearm will be inherited or administered during incapacity of an owner. Gun Trusts are an answer to providing written guidance specific to possession and transfer of firearms to avoid potential criminal liability for getting these wrong.

Benefits of a Gun Trust. A gun trust can avoid some of the federal transfer requirements and accomplish other goals as well:

Making a Gun Trust. A gun trust is quite different from the common revocable living trust, which is used, like a will, to leave your assets at death. A simple living trust allows survivors to transfer trust assets without going through probate court, which saves time and money after your death. It generally terminates shortly after your death, when the trust assets have been distributed to the people who inherit them. A gun trust may have multiple trustees, be intended to last for more than one generation, and must take into account state and federal weapons laws. If you want to leave guns in trust, consult with a lawyer who has knowledge of the state and federal laws that govern who can legally use and possess weapons and how they must be transferred. What is the Generation Skipping Transfer Tax?

The federal generation skipping transfer (GST) tax is a tax on the transfer of property to a person who is two or more generations below the generation of the transferor. The transferor is the person who has transferred property to another, or to a trust for the benefit of another, in a manner that is subject to the gift or estate tax. The most common example of a GST is a gift or bequest from a grandparent to a grandchild. The GST tax is imposed on gifts a transferor makes during life or after death. It is applied separately from, and in addition to, the federal estate and gift taxes. Each US citizen receives an exemption for the GST tax that, in 2016, allows one to transfer $5.45 million of property during life or at death free from GST tax. This GST exemption amount, which increases each year with inflation, is allocated, either by election or automatically, to the transfers that may be subject to the GST tax. Generally, the GST tax is only a concern if a transferor will be giving more than the $5.45 million exemption amount away to grandchildren, trusts for grandchildren, or other people two or more generations younger than the transferor. What is the purpose of the Generation Skipping Transfer Tax? The transfer tax regime assumes that one generation will pass wealth to the next generation, which will then pass wealth to the next, without skipping a generation in between. In that way, as wealth gets passed from one generation to the next, it will be subject to a transfer tax (either estate or gift) at each generational level. However, before the implementation of the GST tax, wealthy individuals could circumvent the intergenerational taxation of assets. Savvy transferors who had enough wealth could leave a portion to a child and gift the balance it to future generations, either directly or in trust. This technique allows transferors to avoid the transfer tax that would have otherwise been imposed at each successive generation’s level. For example, if grandfather passes $100 million dollars to child, and child then passes $75 million of that inheritance to grandchild, the assets will be subject to the estate tax at both grandfather’s death and at child’s death. If grandfather passes $25 million to child and $75 million directly to grandchild, the $100 million will still be taxed at grandfather’s death. But, the $75 million that went to the grandchild will avoid another estate tax at child’s death. It will not be included in child’s estate since child never received it. If grandfather had chosen to put the assets in a trust for multiple generations of beneficiaries (known as a dynasty trust), the assets could pass for generations without ever again being subject to another transfer tax. The GST tax is effectively a 'backstop' tax that prevents a wealthy transferor from avoiding transfer taxes by skipping over generations of beneficiaries. With the GST tax, property that would otherwise be taxed only once at the transferor’s level will be taxed again when it passes to younger generations. Do I need to be concerned about the Generation Skipping Transfer Tax? When meeting with an attorney to discuss your estate planning goals, it is important that you are aware of and discuss the total value of your estate assets. To help our clients address this issue, Swenseth Law Office, works with estate planning clients to put together an Asset Value List to determine whether there are any possible GST tax issues and possible alternative planning options, while also creating a snapshot of your wealth and accounts to assist your personal representative and beneficiaries in the event of your death. To schedule an appointment to review your estate plan, call 701-662-5058. People often expect that an estate plan will provide for traditional assets like a home, jewelry, cash or bank accounts. Many people are unaware, however, of the extent of their digital assets created and used in daily life, as well as what happens to those digital assets upon death. More and more often, individuals rely on online accounts and own assets that may exist only on the Internet. These “digital assets” may include financial accounts, internet-based businesses, social media accounts, photographs, documents, and other digital files. Each of these assets may require a different username and password to access and manage.

What Are Digital Assets? “Digital assets” consist of any:

Some categories and examples of digital assets include:

Importance of Planning for Digital Assets There are several reasons why it is important to plan for digital assets. Proper planning may:

Although placing instructions in a power of attorney, will, trust or other freestanding document may not guarantee that your instructions will be followed, doing so would make it much more likely. Make clear in a power of attorney, will, trust or other document whether you would like for your fiduciaries to have management authority over digital assets or whether you would like to specifically withhold such authority. Options in Planning for Digital Assets Power of Attorney Instructions can be added to a financial power of attorney granting or withholding the authority to manage the online accounts and digital assets and access to the content of electronic communications. Will or Trust Instructions should be added to a will or trust granting or withholding from the personal representative or trustee the authority to manage digital assets and have access to the content of electronic communications. In addition, the disposition of digital assets may be provided for in the will or trust, either adding them as a specific bequest or simply including them in the list of personal effects given to a spouse or children. Some digital assets may not be transferable upon death, but some may be, so wishes regarding disposition should be made clear just in case those wishes can be followed. Grant Immediate Access Some service providers, such as Shutterfly and DropBox, specifically allow multiple individuals to have access. If you are willing to allow others to have access to some assets now, check your service provider's terms of service for this option. Our office has received several calls from recent homebuyers that have discovered defects in the purchased property soon after moving into their recently purchased home. I’d like to take this opportunity to go through the advantages of working with a dedicated buyer’s agent when approaching a real estate transaction.

A Buyer’s Agent has a fiduciary responsibility to represent the home buyer’s best interests in all aspects of the purchase process: the home search and property valuation counseling; purchase offer strategy and negotiation; the due diligence phase of disclosure, investigation and inspection; and any renegotiation of price and terms; and all other aspects of the transaction. A Listing Agent has a fiduciary responsibility to the property seller. The listing agent may assist the buyer, but does not represent the buyer. The listing agent must put the seller’s interests first throughout the purchase negotiation and transaction—while still complying with statutory requirements for honest and fair dealing, and material disclosure to the buyer. Generally speaking, it is not in the best interests of buyers to use the listing agent to represent them in the purchase. If a listing agent tells you, as buyer, that he or she can get you a special deal because of a relationship with the seller, it is probable they have already violated their legal responsibilities and the Realtor Code of Ethics. Unlike a listing agent, a buyer’s agent has a fiduciary obligation and loyalty to the home buyer alone:

"Mediation" is a process by which a non-judicial neutral mediator facilitates communication between parties to assist the parties in reaching voluntary decisions related to their dispute.

Divorce and custody disputes are often known for conflict and adversarial conversations—two spouses, backed by their aggressive lawyers, will fight it out over every last asset. Often times in a farming community, the assets divided in a divorce proceeding are necessary to keep the family business operating. While we strive to uphold the rights of our clients, we believe in a cooperative approach. Mediation is one of the many methods we employ to provide strong, mutually-beneficial solutions to our clients facing family conflict. Mediation is a legal proceeding where a neutral third party helps two other parties facilitate an agreement. Whether the agreement provides for the terms of a divorce or child custody, Swenseth Law Office is prepared to provide mediation services. Unlike a court proceeding, a mediator does not pass judgment or make a decision in any way. Their purpose is to help both sides come to an agreement that is best for everyone. How Mediation Can Help with Your Divorce Good mediation is the result of two voluntary parties—however, mediation is sometimes prescribed by the court. A mediator is legally required to take no side because the purpose of mediation is negotiation, not “winning.” The advantage of mediation is that it avoids the uncertainty of court decisions. Clients who cannot find a solution in mediation have the freedom to pursue other solutions—in contrast, once a court passes judgment, both parties must abide by the decision for better or worse. At its core, mediation is constructive and cooperative. It is about rebuilding something better out of the marriage, rather than destroying and dividing the pieces. It can be a more pleasant experience, empowering two reasonable parties to reach an agreement that requires no judge to impose a court order. Good mediators ensure that the process is fair and unencumbered by adversarial posturing or aggression from either side. Creative Solutions to Complex Problems At our firm, we genuinely believe in the power of mediation. A mediator can help you find the best solution possible, without fear of unfairness or imbalance. Our mediators genuinely seek the best results for both parties. Our passion for cooperation that preserves mental and emotional well-being expresses itself through our work. To best serve our clients, we have added a friendly face to our team. Rachel has joined us to assist our clients dealing with divorce and disputes over parental rights.

Rachel is also currently serving as the Juvenile Public Defender for the Spirit Lake Tribal Court in Fort Totten, ND. She is responsible for representing parents in child abuse/neglect proceedings in the Tribal Court. Her focused areas of practice include family law, Federal Indian law, and Tribal law. Rachel was born and raised in Grand Forks, North Dakota and attended the University of North Dakota in Grand Forks, where she graduated with a Bachelor of Arts in Indian Studies. She continued at UND for law school and graduated with the Indian Law Certificate in May 2015. Rachel’s experience includes working in all levels of the justice system. Rachel has interned for the United States Attorney’s Office, the Standing Rock Tribal Court Prosecution Office, the Walsh County State’s Attorney’s Office and has also had experience in private practice working for a private firm in Minot, ND. Rachel is a licensed attorney in the State of North Dakota, in Federal District Court for the District of North Dakota, and in the Spirit Lake Nation Tribal Court. She is a member of the State Bar Association of North Dakota and also the Federal Bar Association. Rachel enjoys spending time with family and friends, attending concerts and spending the summertime at her husband’s family lake cabin located on West Battle Lake, MN. Will you be our next receptionist/legal assistant? Click here for the details.

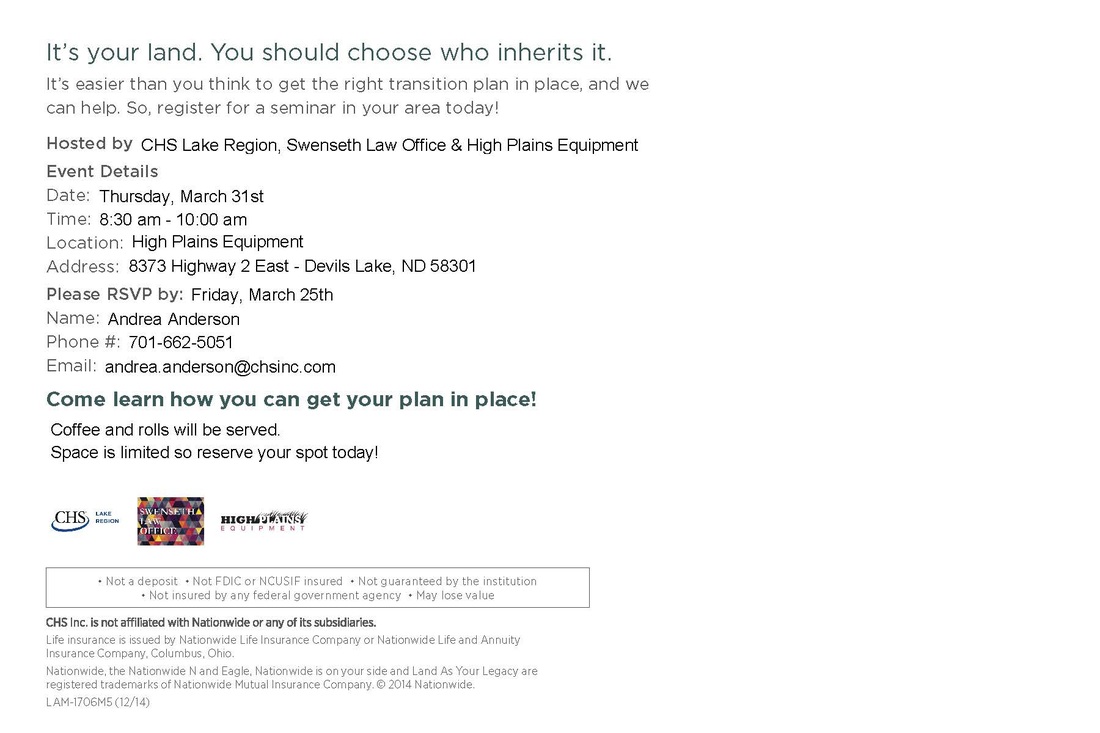

Swenseth Law Office is partnering with CHS, Nationwide, and e4 Brokerage to help our area farmers get started on their estate plan. Sign up to attend a seminar in Devils Lake at High Plains Equipment on March 31st to learn about common concerns and planning issues specific to farm families.

|

RSS Feed

RSS Feed