SWENSETH LAW

|

If you are married, and you or your spouse has been in the hospital and/or rehab and/or nursing home for more than 30 consecutive days, you may already be in a Medicaid spend-down for long term care coverage. And you don’t even realize it!

Let’s start with a discussion of the amount of savings or assets that the “well spouse” can keep when the “ill spouse” asks Medicaid to pay for his or her long term care. By savings or assets, I mean what is left at the end of the month after income is received and bills are paid. Medicaid labels savings and other assets as “resources.” The amount of resources that the “well spouse” can keep at the time the “ill spouse” gets Medicaid coverage is called the Community Spouse Resource Allowance, commonly abbreviated to CSRA. For most couples, the CSRA is half of the assets at the time the “ill spouse” had to move out of the house for medical reasons and stayed out of the house for 30 days or more. The first day of the month during which the “ill spouse” moved out is called the “snapshot date.” (That’s not the official terminology, but I like that term because it’s the most descriptive of what happens.) Please realize that, on the “snapshot date,” the “ill spouse” is almost always still at home and may not realize that, before the month is over, he or she will be out of the house for medical care and/or custodial care for an extended period of time. (The “ill spouse” is out of the house on the “snapshot date” only if the “ill spouse” becomes ill or gets injured on that first day of the month.) The “snapshot date” on the first day of the month seems illogical because, most of the time, nothing medical happens on that day. It’s logical only when you realize that Medicaid works in whole months. It’s just too difficult to break financial records down into individual days. If the couple had less than $47,688 on the “snapshot date,” the “well spouse” will be allowed to keep more than half of the resources because the “well spouse” is allowed to keep the first $23,844 of resources as the minimum CSRA. (Unfortunately, if the couple has less than $23,844, Medicaid will not give money to the “well spouse” to bring him or her up to the minimum.) If the couple has more than $238,440 in resources, the “well spouse” will not be able to keep a full half because the maximum CSRA is $119,220. Any resources above the “well spouse’s” $119,220 will be attributed to the “ill spouse.” Note: The minimum and maximum CSRA are adjusted each year for inflation (if there is inflation.) The Medicaid page at ProtectingSeniors.com is updated from time to time with these amounts and other related Medicaid eligibility figures. If the couple has between $47,688 and $238,440, the CSRA is half of the resources. Note: Some assets, most notably the couple’s home, are not counted in “resources.” So, after all that, the “ill spouse’s” resources at the time he or she asks Medicaid for help is the couple’s total resources above the CSRA (that the “well spouse” gets to keep) and the $1,500 that the “ill spouse” gets to keep (expected to become $2,000 in July 2016.) All of the couple’s resources above the CSRA plus $1,500 must be spent-down before Medicaid will cover the “ill spouse’s” expenses for long term care. So, why does all this minutia mean that someone might already be in a spend-down. It matters because the “snapshot date” isn’t tied to long term care. It’s tied only to the “ill spouse’s” absence from the home for medical reasons for at least 30 days. The “snapshot date” from an injury or illness earlier in life (but still during the marriage) may be useful to save assets if the “ill spouse” later needs long term care. I know, you’re still confused. That last paragraph didn’t help, did it? (Some people would describe that as a good lawyer’s answer: entirely correct but completely incomprehensible.) So, let’s tell this with a story. For the rest of this discussion, I’m going to give names to the “ill spouse” and the “well spouse” in hopes of keeping further confusion to a minimum. So, the “ill spouse” is going to be Ward, and the “well spouse” is going to be June. Ward dropped a cleaver (sorry, couldn’t resist) on his foot 10 year ago, on January 6. He needed surgery and several weeks of rehab. He returned home on February 5 . (As long as he was out for 30 days, additional days don’t matter for this discussion.) Let’s say that Ward and June had $100,000 in resources on January 1 ten years ago (the “snapshot date” for his foot injury.) Ward recovered and returned to work. He continued to make money, and their savings grew. So, now, 10 years later, Ward has a debilitating stroke. June can’t take care of him by herself and needs to move Ward into a nursing home. (By the way, this scenario also applies to home care and to assisted living.) June would like to apply for Medicaid to help pay for Ward’s care. At the time of Ward’s stroke, they have $200,000 in resources (on the first of the month.) Based on the $200,000 in current resources, Ward would have to spend-down $98,500 (the amount left after half of $200,000 is reserved for June and $1,500 is reserved for Ward) before Medicaid will pay for Ward’s care. BUT, Ward has already had a “snapshot date.” Ten years ago, he was out of the house for medical reasons for at least 30 days. At that time, he and June has $100,000 in countable resources. As a result, Ward needs to spend down only $48,500 to get Medicaid coverage to pay for his nursing home stay after the stroke. June was allowed to keep $150,000 rather than $100,000. BIG DIFFERENCE. Note: The “snapshot date” resulting from Ward’s cleaver accident applies only to Ward’s future need for long term care. If June, rather than Ward, has the stroke, the earlier “snapshot date” doesn’t apply. Now, if June had a significant illness or injury of her own that resulted in her own medical stay out of the house for at least 30 days at some point in the past, that would create her own snapshot date. So, if you’ve stuck with me during this 1,000 word shaggy dog story, here’s the payoff: If you know a couple (maybe you and your spouse) in which one of them has had a 30 day stay out of the house for medical reasons, the couple should preserve all of their financial records from that time. (For example, bank statements, investment statements, real estate values, IRA statements, life insurance cash values, and annuity statements.) Those records might be very valuable in case the same person needs long term care in the future. Boy, that installment was about as difficult to follow as War and Peace. Sorry about that. I couldn’t find a way to make it any simpler. For the original article, please visit Protecting Senior News

0 Comments

FORMING AND DOCUMENTING AN EMPLOYMENT RELATIONSHIP

At the outset of the employment relationship, startup business owners must determine the terms and conditions on which they will hire and employ individuals. Specifically, employers have to decide issues such as:

RISKS IN THE HIRING AND INTERVIEW PROCESS Employers, including startups, face potential liability risks in the hiring process. Key areas of exposure include:

WAGE AND HOUR ISSUES Wage and hour issues can be especially difficult for startups. In the startup environment, most employees work long hours. They also do not necessarily operate within clearly delineated roles or traditional job titles, often performing the functions of multiple jobs within a given day or week. Compensation may be primarily comprised of stock or equity grants, with little cash flow available for base wages. Many startups never contemplate paying overtime to their employees, operating under the false assumption that the overtime laws are inapplicable to startups. Nonetheless, startups remain vulnerable to potential wage and hour liability arising from employee claims and agency audits. Therefore, they should take time to consider wage and hour compliance as part of their initial business planning and strategy. These concerns become increasingly important as the company’s workforce expands, or as the business positions itself for additional rounds of financing, a public offering or an acquisition. Key considerations include:

Entrepreneurs and startup business owners often focus their time and energy on financing the business and developing and marketing their core products or services. As their businesses grow and they hire more employees, complying with the numerous federal, state and local employment laws is not generally of primary concern as they attend to other business demands. However, non-compliance with these laws can pose substantial risks. Determining who will oversee employment and

human resources-related issues, and how to handle them, should be among the key considerations for startups. EMPLOYMENT-RELATED FILING, REPORTING AND INSURANCE REQUIREMENTS When hiring their first employees, even startups must comply with numerous filing, reporting and insurance requirements. In addition to federal requirements, many states require businesses to report information about their employees. For example, before hiring any employees, a business owner must:

IMMIGRATION ISSUES AND FORM I-9 COMPLIANCE The federal Immigration Reform and Control Act of 1986 (IRCA) prohibits:

EMPLOYMENT-RELATED INSURANCE REQUIREMENTS In most states, businesses are required to maintain or pay into funds to support insurance to protect their workforce, including:

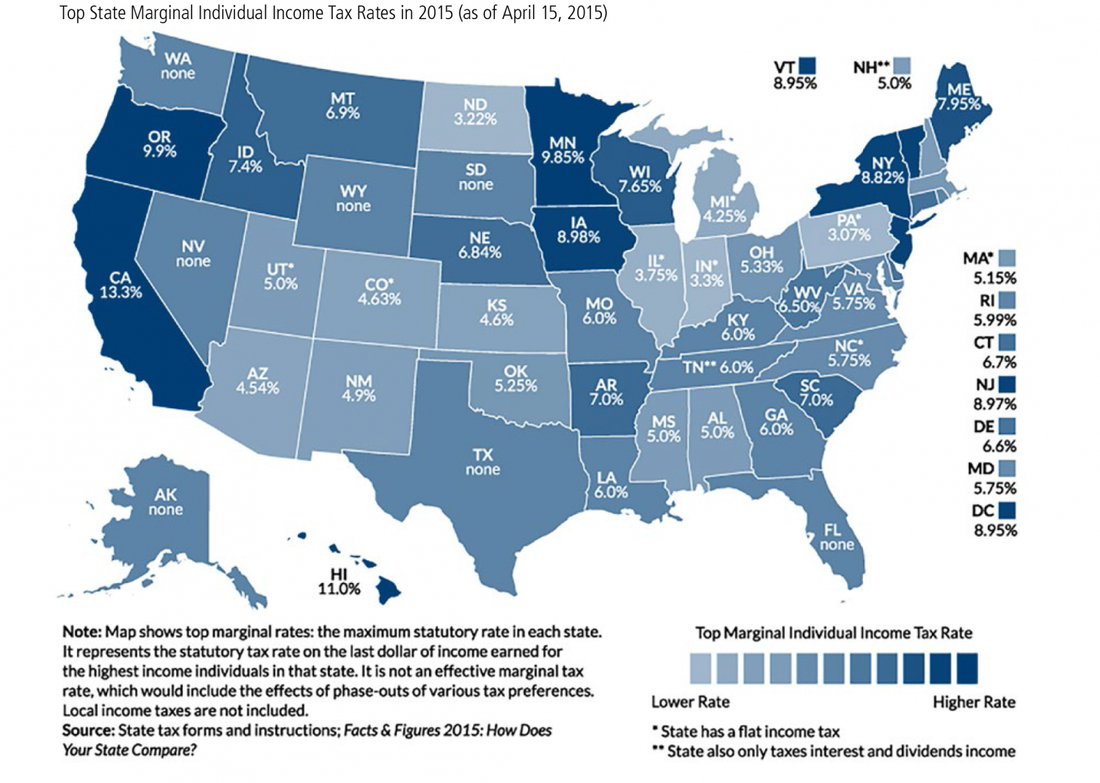

Taxes are a growing concern, particular high-net-worth individuals. A great deal of ink has been spilled recently discussing increased awareness of the federal taxes, but what about the state taxes that are paid over time. Each state maintains its own tax laws to collect income or estate (or inheritance) tax. These different laws may have a significant impact on a taxpayer’s decision to relocate during retirement. Saving state income tax dollars can help improve cash flow and spending power in a meaningful way during retirement. Saving state estate tax dollars also can help increase the legacy that someone can leave to their family. As the “baby boom” generation retires, wealth preservation discussions increasingly involve decisions to relocate to another state. A retiree may enjoy nicer weather or a change of scenery, but he or she may enjoy some beneficial tax savings as well. Income Taxes Income tax rates vary widely from state to state. Some do not tax income at all (such as Florida, Nevada, South Dakota, Texas, Washington and Wyoming). Other states have tax rates that approach or exceed 10 percent. Some municipalities within states even maintain additional, regional income taxes. Some states distinguish between taxing wage income as compared to investment income (such as New Hampshire and Tennessee). Still other states distinguish between taxing retirement income as compared to other income. Within the states that do not tax retirement income, some distinguish among social security benefits, public and private pensions benefits and retirement account distributions when determining exemptions and taxes. It’s a complicated patchwork of jurisdictions and rules, but the accompanying illustration can provide some more clarity. Estate Taxes Prior to June of 2001, most states collected estate taxes based on the federal state death tax credit. In other words, they would collect one dollar of estate tax for each dollar of credit allowed on a federal estate tax return. After June of 2001, Congress changed the estate tax laws significantly over time. These changes ultimately phased out the federal state death tax credit. As a result, the majority of states (29) no longer collect any estate or inheritance taxes. Other states (6), however, still maintain their own inheritance tax system. A couple (2) collect both estate and inheritance taxes. Still other states (13 plus Washington, DC) have “decoupled” from the estate tax system by recognizing a lower estate tax exemption amount than the one available for federal estate tax purposes. Even though a taxpayer may not be subject to the federal estate tax due to its higher exemption amount, that taxpayer may be subject to a state inheritance or estate tax in light of these changes. Some taxpayers consider changing residency during retirement in part to avoid these estate and inheritance taxes. Moving Away Speaking in the broadest terms, there are a couple of options that taxpayers consider when relocating during retirement. Some taxpayers sell their home and relocate to another state. Others purchase another home and share time between their primary and seasonal homes. The problem with the latter approach usually revolves around two concerns. First, states often define residency differently for tax purposes. Second, the state a taxpayer has left usually will miss those taxpayer dollars (and may still try to collect them if possible). Many states that are losing tax dollars have increased their audit practices, especially in cases where taxpayers retain some connection to their state. These states may not simply accept a round trip plane ticket to bookmark the dates a taxpayer claims to be absent from that state. They now may review a long list of facts and circumstances to demonstrate a taxpayer’s true intent to make a new home a permanent residence. Taxpayers must plan carefully when moving from one state to another while retaining more than one home. For this purpose, it’s not only important for a taxpayer to prove he or she has arrived in a new home state; it’s also important for that taxpayer to demonstrate a formal departure from the prior home state. This burden could prove difficult when the taxpayer maintains a home and other ties to the former state for family or social reasons. Failure to plan properly could result in paying more state income taxes than intended. This situation could arise not only because states collect taxes at different rates but also because states don’t necessarily offer credits for taxes paid to another state. In other words, income taxes could be due in more than one state. And, these costs could be surprising and significant. Original Source: Wealth Management December 1, 2015

BISMARCK, N.D. – The North Dakota Department of Human Services’ Division of Vocational Rehabilitation (VR) and the North Dakota State Rehabilitation Council are sponsoring community meetings about workforce services next week in Minot and Fargo. They are inviting employers and business representatives to attend and to share comments and insight into vocational rehabilitation efforts and workforce programs intended to help businesses recruit and retain workers.

“Every year, we host community meetings to hear directly from stakeholders interested in workforce needs and the employment of people with disabilities,” said Russ Cusack, VR Division director. “The feedback we collect helps shape our state plan and identify priorities for the upcoming year.” Cusack said the division wants to hear from employers who have job openings and currently work with VR, as well as employers who need workers and may be less familiar with the division’s services. VR professionals, he said, can match clients who have the required skills and abilities with job openings. “We can also help employers retain their experienced workforce,” Cusack said. “If a business has an employee who is struggling with an injury, illness, or impairment, we can visit with the employer and employee and help them figure out an accommodation. Modifying a workplace is often low-cost and may be as simple as rearranging a work station.” During the 2015 Federal Fiscal Year, VR professionals worked with both employers and individuals with disabilities and helped 531 North Dakotans obtain and maintain employment. Employers can also submit written comments until 5 p.m., on Friday, Dec. 18, 2015. Send comments to Marv Erhardt, Discovery Consulting, 1527 Territory Dr., Bismarck, N.D., 58503 or [email protected]. The 2013-2014 VR State Plan is online at www.nd.gov/dhs/dvr/policies/state.html. It can also be obtained by calling 701-328-8950, 800-755-2745, or ND Relay TTY 800-366-6888. General public comment meetings will also be held in Minot on Dec. 8 and in Fargo on Dec. 10. Details are available online at www.nd.gov/dhs/info/publicnotice/2015/10-23-vocational-rehabilitation-state-plan-public-comment-meetings.pdf Individuals who need accommodations, including auxiliary aids or other services to participate in the meetings, should contact Erhardt at 701-223-1192, or ND Relay TTY 800-366-6888. North Dakota is a leader in the employment of people with disabilities. VR Division information is available online at www.nd.gov/dhs/dvr/index.html. Local VR Office location information is listed on the Web at www.nd.gov/dhs/dvr/about/regional-contact.html. For more information, contact public information officers Heather Steffl at 701-328-4933 or LuWanna Lawrence at 701-328-1892. Keeping your financial records in order is hugely important to the success of your business. Not only does it keep you up-to-date on your profits and losses, but legally speaking, it’s necessary to have your records straight. It makes the close of your fiscal year easy to execute by ensuring that all of your required statements are in the right place. This is especially important for dealing with the IRS.

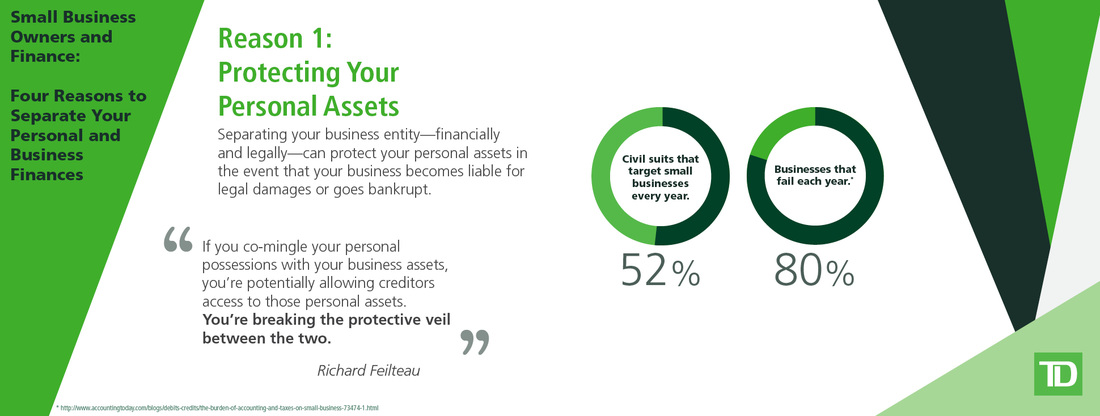

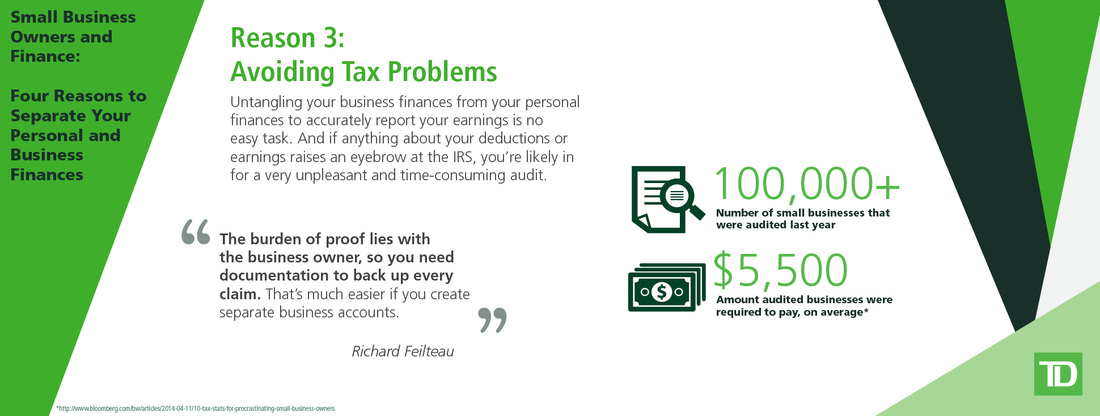

Understanding just what exactly goes into a fiscal year close can be confusing, however, especially for new small business owners. Even if you have an accountant on staff or retainer, it’s still important to keep track of your finances yourself. It just makes good business sense for you, as the owner, to understand what exactly is happening with your money. Let’s examine the steps you should take when closing out your small business’ books for the end of the fiscal year. 1. Review your profit and loss statements Your business' profit and loss statements will help you get a snapshot of its financial performance. What does your revenue look like now that the year is almost through? Do you anticipate any other large expenses to hit your books? If not, evaluate how much money you have available, and see if it might be wise to make a larger purchase before the end of the year so that the item can depreciate. 2. Verify Your Vendor and Lender Files It’s important to review the paperwork—including 1099s—associated with any of your vendors, as well as information relating to any current outstanding loans. Make sure all of your vendor 1099 forms are up-to-date and accurate. You also want to make sure the 1099 information has been inputted correctly into youraccounting system so that it’ll populate the forms when printed. 3. Take Inventory If you sell products, conduct an inventory assessment and compare the results to your last inventory report. Make any necessary adjustments so that you have an accurate account of how much capital you have wrapped up in your current inventory. Even if you don’t sell products, it’s not a bad idea to take an inventory of elements in your office, such as equipment, computers, office supplies, etc. Make a list of any broken equipment or equipment in need of repair. If you lease any electronics, such as copiers, pull out the contract associated with it and make sure the terms are still appropriate for your situation. 4. Look for Benefits to Report on Your Outgoing W-2 As a business that issues W-2s, these benefits relate to the organization as a whole and can reflect things such as health and life insurance, transportation subsidies, educational reimbursement programs and more. 5. Create a Budget for the Following Year It’s never too early to plan. By reviewing your statements from the current year, you’ll start to see a pattern in the things you need to budget and plan for in the next year. By taking stock of your expenditures from the current year, you’ll have a better understanding of where to focus your efforts moving forward. Original Source Four Reasons Small Business Owners Should Consider Separating Personal and Business Finances10/30/2015 If you're a business owner who is co-mingling your finances, you're not alone. But this practice is risky, causing problems at both the operational and the fiscal level. original source:

You’ve worked hard to build your business and you’re thinking, what’s next? If selling your business is in your future, know that preparing for a successful sale can be a long-term process. To maximize the value of your business, you’ll need to plan and prepare well in advance. The attached PDF by Dan Wright provides a guide to preparation.

Original Source: http://www.leadingedgealliance.com/thought_leadership/10%20Must-DosBeforeSellingBusinessCLARKNUBER.pdf Single? Estate planning is still essential

By Matthew T. McClintock, J.D. Vice President, Education, WealthCounsel These days, more people are living single than ever before. In 1970, just about one- third of Americans 15 and older were single, according to U.S. census data. Today, that number’s closer to 50 percent. Whether never married, divorced or widowed, singles need to pay just as much attention to their estate planning as married folks, as highlighted in a recent Wall Street Journal article. Single people face unique estate planning issues that require advanced planning, time and the help of an experienced professional. Some of the most complicated estate planning issues for singles include: Heirs: When married people die without a will, their assets typically pass to their spouse. But what about single people? Assets are usually distributed along bloodlines, so children (if any), followed by parents, siblings or other relatives, would be the default heirs. If a single person has no living relatives, his or her assets might wind up with the state. To ensure their assets wind up with the relatives, loved ones and charitable organizations that they’d prefer, single people should create a will and/or an irrevocable trust that specifically states how they’d like their assets to be distributed. Decision makers: A health event or other incident could leave any of us incapacitated. For single people, it’s important to designate a trusted loved one or friend to manage assets and health care decisions in case of an emergency. Without proper directives, those decisions could fall to distant relatives or state-appointed strangers. Single people should sign a general power of attorney, an advance health care directive, and a HIPAA authorization allowing a loved one of choice to make financial and medical decisions on their behalf. Beneficiaries: Certain accounts, like retirement plans, require account holders to designate a beneficiary when they enroll. That beneficiary designation is typically upheld when the account holder dies, even if he or she gave the account to someone else in a will. Previously married or widowed singles should reevaluate all of their beneficiary designations to ensure accounts won’t be given to former spouses if that’s against their wishes. Those are just a few of the ways estate planning can be complicated for singles. It’s wise for single people to contact an estate planning professional as soon as possible, in order to make sure all their bases are covered and their assets are distributed according to their wishes. Original Source: http://www.estateplanning.com/Single-Estate-planning-is-still-essential/ EstatePlanning.com™ is a service provided by The WealthCounsel Companies, a nationwide collaborative of estate planning attorneys and wealth planning professionals who are dedicated to providing the best planning possible for American families.

Members of The WealthCounsel Companies are committed to client-centered estate planning and wealth management. This approach benefits you because it facilitates collaboration with your entire team of professional wealth advisors. That's why we encourage you to insure that all of your wealth planning professionals (attorney, insurance agent, financial advisor, CPA, etc.) are effectively communicating and working in unison to support your long-term planning goals. EstatePlanning.com provides you with objective, plain-English resources you need to answer your estate planning questions . . . and to help you better understand estate planning and the estate planning process. EstatePlanning.com can also connect you with an estate planning professional in your geographic area, if you’re so inclined. A common misperception is that estate planning is about planning for your death. Our goal with this service is to help Americans understand that estate planning is so much more. Estate planning is making a plan in advance and naming whom you want to receive the things you own after you die. Top 10 Reasons Why ALL Americans Need an Estate Plan

Original Source: http://www.estateplanning.com/about/ |

|||||||

RSS Feed

RSS Feed