SWENSETH LAW

|

What is the Generation Skipping Transfer Tax?

The federal generation skipping transfer (GST) tax is a tax on the transfer of property to a person who is two or more generations below the generation of the transferor. The transferor is the person who has transferred property to another, or to a trust for the benefit of another, in a manner that is subject to the gift or estate tax. The most common example of a GST is a gift or bequest from a grandparent to a grandchild. The GST tax is imposed on gifts a transferor makes during life or after death. It is applied separately from, and in addition to, the federal estate and gift taxes. Each US citizen receives an exemption for the GST tax that, in 2016, allows one to transfer $5.45 million of property during life or at death free from GST tax. This GST exemption amount, which increases each year with inflation, is allocated, either by election or automatically, to the transfers that may be subject to the GST tax. Generally, the GST tax is only a concern if a transferor will be giving more than the $5.45 million exemption amount away to grandchildren, trusts for grandchildren, or other people two or more generations younger than the transferor. What is the purpose of the Generation Skipping Transfer Tax? The transfer tax regime assumes that one generation will pass wealth to the next generation, which will then pass wealth to the next, without skipping a generation in between. In that way, as wealth gets passed from one generation to the next, it will be subject to a transfer tax (either estate or gift) at each generational level. However, before the implementation of the GST tax, wealthy individuals could circumvent the intergenerational taxation of assets. Savvy transferors who had enough wealth could leave a portion to a child and gift the balance it to future generations, either directly or in trust. This technique allows transferors to avoid the transfer tax that would have otherwise been imposed at each successive generation’s level. For example, if grandfather passes $100 million dollars to child, and child then passes $75 million of that inheritance to grandchild, the assets will be subject to the estate tax at both grandfather’s death and at child’s death. If grandfather passes $25 million to child and $75 million directly to grandchild, the $100 million will still be taxed at grandfather’s death. But, the $75 million that went to the grandchild will avoid another estate tax at child’s death. It will not be included in child’s estate since child never received it. If grandfather had chosen to put the assets in a trust for multiple generations of beneficiaries (known as a dynasty trust), the assets could pass for generations without ever again being subject to another transfer tax. The GST tax is effectively a 'backstop' tax that prevents a wealthy transferor from avoiding transfer taxes by skipping over generations of beneficiaries. With the GST tax, property that would otherwise be taxed only once at the transferor’s level will be taxed again when it passes to younger generations. Do I need to be concerned about the Generation Skipping Transfer Tax? When meeting with an attorney to discuss your estate planning goals, it is important that you are aware of and discuss the total value of your estate assets. To help our clients address this issue, Swenseth Law Office, works with estate planning clients to put together an Asset Value List to determine whether there are any possible GST tax issues and possible alternative planning options, while also creating a snapshot of your wealth and accounts to assist your personal representative and beneficiaries in the event of your death. To schedule an appointment to review your estate plan, call 701-662-5058.

7 Comments

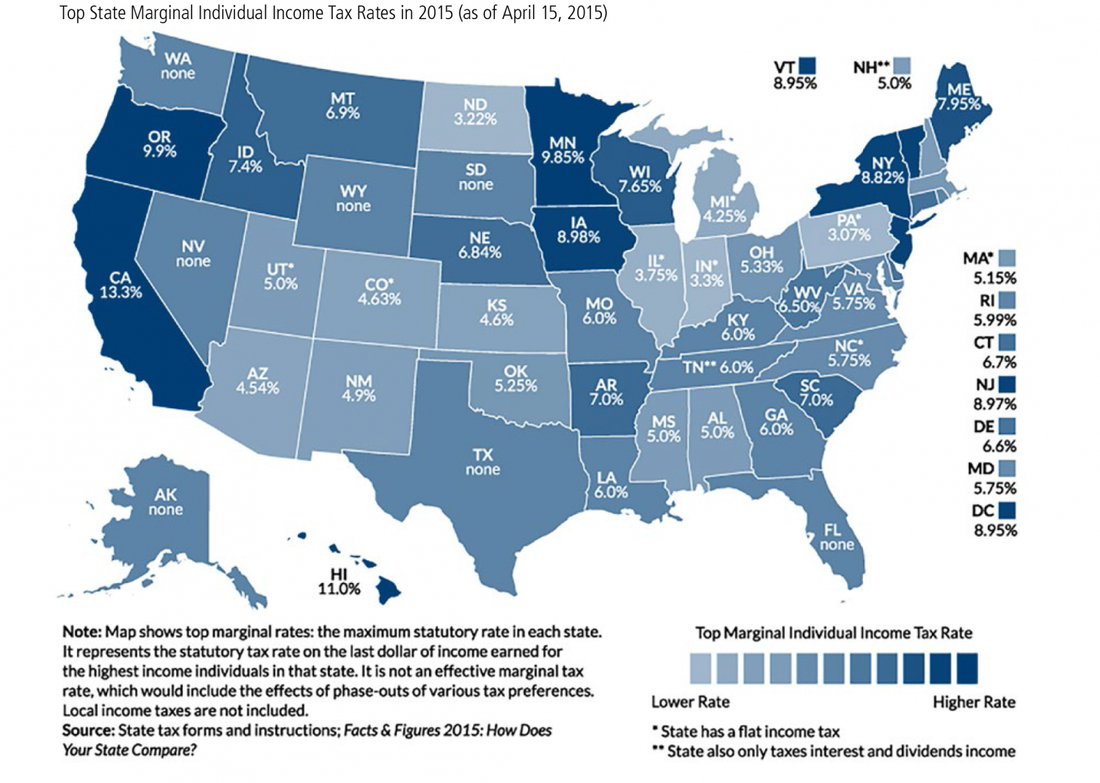

Taxes are a growing concern, particular high-net-worth individuals. A great deal of ink has been spilled recently discussing increased awareness of the federal taxes, but what about the state taxes that are paid over time. Each state maintains its own tax laws to collect income or estate (or inheritance) tax. These different laws may have a significant impact on a taxpayer’s decision to relocate during retirement. Saving state income tax dollars can help improve cash flow and spending power in a meaningful way during retirement. Saving state estate tax dollars also can help increase the legacy that someone can leave to their family. As the “baby boom” generation retires, wealth preservation discussions increasingly involve decisions to relocate to another state. A retiree may enjoy nicer weather or a change of scenery, but he or she may enjoy some beneficial tax savings as well. Income Taxes Income tax rates vary widely from state to state. Some do not tax income at all (such as Florida, Nevada, South Dakota, Texas, Washington and Wyoming). Other states have tax rates that approach or exceed 10 percent. Some municipalities within states even maintain additional, regional income taxes. Some states distinguish between taxing wage income as compared to investment income (such as New Hampshire and Tennessee). Still other states distinguish between taxing retirement income as compared to other income. Within the states that do not tax retirement income, some distinguish among social security benefits, public and private pensions benefits and retirement account distributions when determining exemptions and taxes. It’s a complicated patchwork of jurisdictions and rules, but the accompanying illustration can provide some more clarity. Estate Taxes Prior to June of 2001, most states collected estate taxes based on the federal state death tax credit. In other words, they would collect one dollar of estate tax for each dollar of credit allowed on a federal estate tax return. After June of 2001, Congress changed the estate tax laws significantly over time. These changes ultimately phased out the federal state death tax credit. As a result, the majority of states (29) no longer collect any estate or inheritance taxes. Other states (6), however, still maintain their own inheritance tax system. A couple (2) collect both estate and inheritance taxes. Still other states (13 plus Washington, DC) have “decoupled” from the estate tax system by recognizing a lower estate tax exemption amount than the one available for federal estate tax purposes. Even though a taxpayer may not be subject to the federal estate tax due to its higher exemption amount, that taxpayer may be subject to a state inheritance or estate tax in light of these changes. Some taxpayers consider changing residency during retirement in part to avoid these estate and inheritance taxes. Moving Away Speaking in the broadest terms, there are a couple of options that taxpayers consider when relocating during retirement. Some taxpayers sell their home and relocate to another state. Others purchase another home and share time between their primary and seasonal homes. The problem with the latter approach usually revolves around two concerns. First, states often define residency differently for tax purposes. Second, the state a taxpayer has left usually will miss those taxpayer dollars (and may still try to collect them if possible). Many states that are losing tax dollars have increased their audit practices, especially in cases where taxpayers retain some connection to their state. These states may not simply accept a round trip plane ticket to bookmark the dates a taxpayer claims to be absent from that state. They now may review a long list of facts and circumstances to demonstrate a taxpayer’s true intent to make a new home a permanent residence. Taxpayers must plan carefully when moving from one state to another while retaining more than one home. For this purpose, it’s not only important for a taxpayer to prove he or she has arrived in a new home state; it’s also important for that taxpayer to demonstrate a formal departure from the prior home state. This burden could prove difficult when the taxpayer maintains a home and other ties to the former state for family or social reasons. Failure to plan properly could result in paying more state income taxes than intended. This situation could arise not only because states collect taxes at different rates but also because states don’t necessarily offer credits for taxes paid to another state. In other words, income taxes could be due in more than one state. And, these costs could be surprising and significant. Original Source: Wealth Management Keeping your financial records in order is hugely important to the success of your business. Not only does it keep you up-to-date on your profits and losses, but legally speaking, it’s necessary to have your records straight. It makes the close of your fiscal year easy to execute by ensuring that all of your required statements are in the right place. This is especially important for dealing with the IRS.

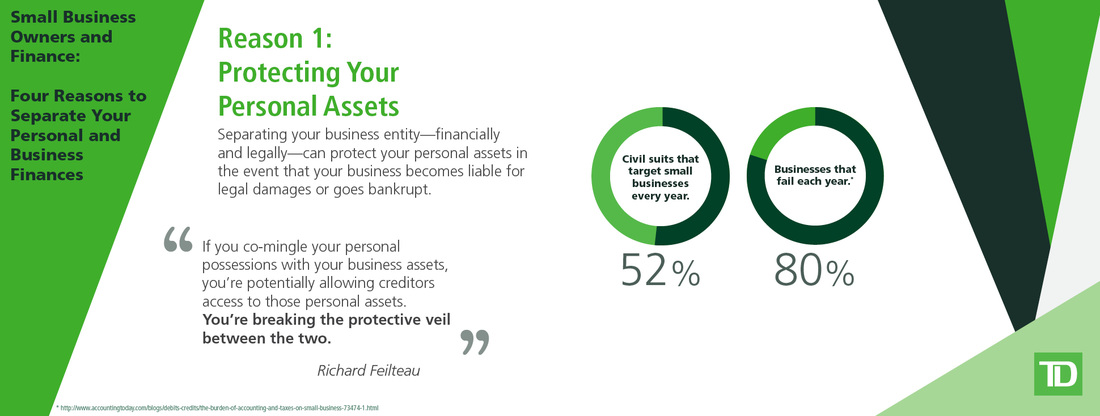

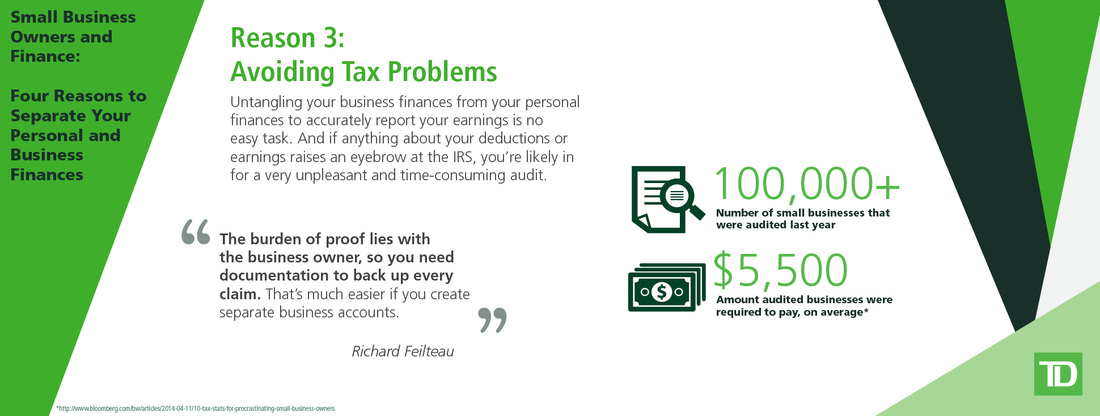

Understanding just what exactly goes into a fiscal year close can be confusing, however, especially for new small business owners. Even if you have an accountant on staff or retainer, it’s still important to keep track of your finances yourself. It just makes good business sense for you, as the owner, to understand what exactly is happening with your money. Let’s examine the steps you should take when closing out your small business’ books for the end of the fiscal year. 1. Review your profit and loss statements Your business' profit and loss statements will help you get a snapshot of its financial performance. What does your revenue look like now that the year is almost through? Do you anticipate any other large expenses to hit your books? If not, evaluate how much money you have available, and see if it might be wise to make a larger purchase before the end of the year so that the item can depreciate. 2. Verify Your Vendor and Lender Files It’s important to review the paperwork—including 1099s—associated with any of your vendors, as well as information relating to any current outstanding loans. Make sure all of your vendor 1099 forms are up-to-date and accurate. You also want to make sure the 1099 information has been inputted correctly into youraccounting system so that it’ll populate the forms when printed. 3. Take Inventory If you sell products, conduct an inventory assessment and compare the results to your last inventory report. Make any necessary adjustments so that you have an accurate account of how much capital you have wrapped up in your current inventory. Even if you don’t sell products, it’s not a bad idea to take an inventory of elements in your office, such as equipment, computers, office supplies, etc. Make a list of any broken equipment or equipment in need of repair. If you lease any electronics, such as copiers, pull out the contract associated with it and make sure the terms are still appropriate for your situation. 4. Look for Benefits to Report on Your Outgoing W-2 As a business that issues W-2s, these benefits relate to the organization as a whole and can reflect things such as health and life insurance, transportation subsidies, educational reimbursement programs and more. 5. Create a Budget for the Following Year It’s never too early to plan. By reviewing your statements from the current year, you’ll start to see a pattern in the things you need to budget and plan for in the next year. By taking stock of your expenditures from the current year, you’ll have a better understanding of where to focus your efforts moving forward. Original Source Four Reasons Small Business Owners Should Consider Separating Personal and Business Finances10/30/2015 If you're a business owner who is co-mingling your finances, you're not alone. But this practice is risky, causing problems at both the operational and the fiscal level. original source:

You’ve worked hard to build your business and you’re thinking, what’s next? If selling your business is in your future, know that preparing for a successful sale can be a long-term process. To maximize the value of your business, you’ll need to plan and prepare well in advance. The attached PDF by Dan Wright provides a guide to preparation.

Original Source: http://www.leadingedgealliance.com/thought_leadership/10%20Must-DosBeforeSellingBusinessCLARKNUBER.pdf  Despite their wealth and business savvy, more than one-third of high-net-worth families have not taken the most basic steps to protect and provide for their loved ones when they die, according to a recent survey by CNBC.com. The CNBC Millionaire Survey found 38 percent of those with investable assets of $1 million or more have not used a financial expert to establish an estate plan, while 62 percent have. Individuals with $5 million or more (68 percent) were more likely to do so, compared to those with $1 million to $5 million in assets (61 percent), according to the survey, conducted by Spectrem Group for CNBC, which polled 750 millionaires. Republicans (68 percent) were also more likely to use a financial advisor to establish an estate plan than Democrats (61 percent) or independents (58 percent). The numbers don't surprise Mitch Drossman, national director of wealth-planning strategies for U.S. Trust, who said the constant changes to the federal estate-tax law for nearly a decade (until it was made permanent in 2013) resulted in "estate-planning fatigue." "We have had an incredible amount of uncertainty with respect to estate taxes, and every change led advisors to reach out to their clients to explain these changes and be sure their documents were up to date and reflective of those changes," he said. "Clients finally said, 'Enough already.'" The higher federal estate-tax exemption amount, which now stands at $5.43 million per person due to annual inflation adjustments, has also rendered estate planning a lesser priority for many wealthy families, said David Mendels, a certified financial planner and director of planning for Creative Financial Concepts. Married couples can combine their exemptions to give away $10.86 million tax-free in 2015. "I think people tend to think of estate planning as being primarily a means to reduce estate taxes, and therefore, if they don't have to pay estate tax, they may feel they don't have to do any planning," said Mendels. But 15 states, including New York, Connecticut and Massachusetts, as well as the District of Columbia, levy their own estate taxes, which kick in at much lower thresholds. New Jersey's exemption, for example, is $675,000, Rhode Island's is $921,655, and Maryland's is $1 million. "Depending on where you live, estate taxes may still be a factor," said Mendels. Estate planning, however, is about much more than the size of one's taxable estate, he said. It's a series of documents that protect your assets, provide for your children and delineate your wishes regarding end-of-life decisions. Absent specific instructions, family members are left to guess at what you would have wanted, causing unnecessary stress and infighting. "Estate planning is not necessarily synonymous with tax planning," said Drossman at U.S. Trust. "There are still many valid reasons to do non-tax estate planning to address property management, to protect assets and to address exactly where you stand on issues you may confront later in life, like cognitive decline or disability. "That's going to be a bigger issue with longer life expectancies, better medical care and the aging population," he added. For families with minor children, a last will and testament is the most critical estate-planning document they can have, said Mendels at Creative Financial Concepts. "If you have young children, you need a will," he said. "It's not about the money. You need to name a guardian for your children, in case something happens to you and your spouse." It can also be used to set up trusts for any property your child will inherit and to name a trustee to handle the property until your child reaches the age you specify. Failure to do so means the courts would have to decide who is best suited to care for your children if tragedy should strike. A medical power of attorney is another important weapon in your estate-planning arsenal, authorizing an individual to make health-care decisions on your behalf in the event of physical injury or cognitive impairment. If you're married, that's typically your spouse, but if he or she dies first, you'll need a backup—ideally, someone who is geographically nearby who can communicate in person with your health-care providers, said estate-planning attorney and CFP Austin Frye, founder and president of Frye Financial Center. "If, God forbid, you are put in a situation from which you are not going to recover, you want to keep control over what happens to you," said Frye. Such documents are often created alongside an advanced medical directive for physicians, also called a living will, which clarify your wishes regarding end-of-life medical treatment, including resuscitation and organ donation. (Make sure you have a HIPAA form attached, which grants your power of attorney the right to access your medical records, which are protected under privacy laws.) A durable financial power of attorney document is also necessary, as it identifies the person you'd like to manage your money if you are unable to make decisions for yourself, said Frye. Such legal documents grant that person legal authority to pay taxes on your behalf, borrow money, pay your bills, invest and handle bank transactions. With higher income-tax rates in effect, tools and techniques that help minimize the income-tax hit to your estate—and your heirs—are playing a far bigger role in estate planning today, said Mendels at Creative Financial Concepts. To learn more about how we use your information, please read our Privacy Policy. Indeed, the top marginal tax rate for wealthy taxpayers now stands at 39.6 percent. Those with higher incomes also face a higher capital gains rate of 20 percent instead of 15 percent, a 0.9 percent tax on earned income (wages) and a 3.8 percent Medicare surtax on net investment income, plus the phaseout of personal exemptions and deductions. "As estate taxes have come down, the income-tax consequences are much more important," said Mendels. For example, trusts remain a valuable tool for protecting assets from creditors, legal claims and offspring with poor money-management skills, but due to recent tax-law changes, they could also leave your heirs with less. Effective in 2013, trusts that accumulate income are now hit with the 3.8 percent Obamacare tax that applies to net investment income. The beneficiaries are also subject to the highest income-tax rate of 39.6 percent and the top capital gains rate of 20 percent on any income received from the trust in excess of $12,150. By comparison, the top income-tax rate for individual taxpayers kicks in at $400,000 for single filers and $450,000 for married couples filing jointly. "Trusts are very versatile, and they can do a lot of things, but these are things that need to be thought through," said Mendels. "Your heirs may end up paying much more income tax by leaving property to them in trust than if you just gave it to them outright." Drossman at U.S. Trust said income-tax implications, as a component of estate planning, have taken center stage at his firm, too. That, and what he calls "reverse estate planning." "In some cases we're helping clients unwind or reverse some of the estate planning they had done in the past, because it may no longer be needed, given the significant estate-tax exemption or because it would add to their income-tax cost," he said. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos."-Austin Frye, founder and president of Frye Financial CenterSome families, for example, are taking assets out of trust and giving them outright to their heirs, since they now fall below the estate-tax exemption line. Others created LLCs or family partnerships years ago to facilitate a discounting of assets, but new rules in some cases prevent assets held in such structures to take full of advantage of the step-up in basis. Remember: Those who inherit appreciated property, including real estate and stocks, receive a step-up in cost basis for tax purposes based on the current market value on the date of the benefactor's death. Thus, the beneficiary could sell the property immediately without incurring a capital gain, or sell it years from now and only owe gains based on its price appreciation from the day they inherited it. "If held in a discounted entity, they're not stepped up as high as they would have been had they been held outside that entity," said Drossman. "They may no longer want that in place if they don't benefit from any estate-tax savings, and they get a lower basis." It's never pleasant to contemplate one's own mortality. But high-net-worth families who fail to plan—and there are many—risk exposing their kids' inheritance to creditors, predators and bitter ex-spouses. Worse, they leave life's most important decisions—such as who will care for their kids and whether their spouse should pull the plug—in the hands of the courts. "You have to plan for the worst and hope for the best," said Frye of Frye Financial Center. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos." —By Shelly Schwartz, special to CNBC.com Entrepreneurs thrive on a DIY mentality: Do everything you can yourself and don't pay for anything new until you have absolutely have to. It's especially difficult to justify hiring financial help like a bookkeeper.

With user-friendly software such as QuickBooks available, many business owners feel they should be able to do keep their records on their own, even as they wrestle with finding the time and wonder if they're doing things correctly. Deciding about "hiring a bookkeeper is something I struggle with all the time," says Randy Mitchelson, owner of National Web Leads, an Internet marketing company in Estero, Fla. While he finds basic accounting easy to do, it takes him away from working on his business. Meanwhile, his accounting and tax planning have become only more complicated in the six years since he founded his business. Entrepreneurs who hire accounting help usually discover they weren't doing nearly as well on their own as they thought they were. Zalmi Duchman, chief executive of The Fresh Diet, a meal-delivery company based in Miami, lasted five years without a bookkeeper then hired one three months ago. The new employee cleaned up records that incorrectly mingled expenses and assets, reviewed employee purchases for duplications, and took over the mundane but critical task of paying bills. Duchman estimates his company is saving $500 to $1,000 in late fees every quarter. "I definitely have been able to make better and more educated decisions," he says. So what are a small-business owner's options for professional help with financial tasks? Here is a primer: Do I Need a Bookkeeper or an Accountant? Actually it's a trick question. You may need both. Aaron Sylvan, a serial entrepreneur who lives in New York, compares the situation to needing to hire both a carpenter and an architect when building a house. An accountant can analyze the big picture of your financial situation and offer strategic advice. He or she produces key financial documents, such as a profit-and-loss statement, if needed, and files a company's taxes. After tax season is over, an accountant can also act as an outsourced chief financial officer, advising an entrepreneur on financial strategies, such as whether to secure a line of credit against receivables when introducing new products. In contrast, a bookkeeper does the day-to-day hands-on tasks: making sure new employees file all the right paperwork for the company's payroll, submitting invoices (promptly) and following up on them, and paying the bills. The bookkeeper also tracks company expenses and can assure that every cost has been entered -- and recorded correctly -- into software like QuickBooks so that the business is ready for tax time along with filing any other reporting to, say, creditors or investors. "I don't keep receipts; they're a pain," says Sylvan, who runs Sylvan Social Technology, an ecommerce-services company. "Every month I get a bank statement with a gazillion transactions," such as taxi rides, meals, conferences and other expenses he has placed on his company's debit card. His bookkeeper spends a few hours a week sorting it all out. As a result, Sylvan has a better idea about how his expenditures stack up against his budget. He knows he won't bill clients incorrectly or miss important payments. "Knowledge is power," even when it comes to the small details, Sylvan says. "If you don't have a bookkeeper, you're probably not being as strategic as you could be in how you spend your money." When to Bring in a Bookkeeper In his running a half-dozen businesses the past 15 years, Sylvan has typically hired a bookkeeper for a few hours a week within a few months after starting a new venture. For the first six to nine months, he's usually too busy to focus much on recordkeeping, then "things begin to stabilize," he says. "Then you can see trends and you can start to think strategically about where your money is going and where you can save." And this is when a bookkeeper becomes valuable. Since Sylvan has fewer than a dozen employees at each new company, the bookkeeping takes about one day a month, he says. The rates for hiring a bookkeeper on a part-time basis in the U.S. can range from $15 to $60 an hour, depending on location, the workload and whether work is done at the company's office or from home. Sylvan typically sees his accountant once a year, at tax time. But business owners requiring capital or frequently negotiating credit with a bank are likely to contact their accountants more often. When to Hire a Staff Accountant or Bookkeeper Many small entrepreneurs can probably stick to outsourcing accounting or bookkeeping services for quite some time. The typical service business can often outsource its chief financial officer tasks and bookkeeping until its revenues rises well above the $1 million mark -- or until it has about 30 employees. Until then, most businesses usually don't have enough work to keep a full-timer busy every day. It's time to hire full-time help, though, when you're calling your accountant often enough that you wish he or she were in the office all the time. Bring in a full-time bookkeeper when your part-timer is spending two or three full days in the office and still falling behind. Most new business owners find a staffing solution somewhere along the continuum that ranges from trying to go it alone and paying for full-time help. Original Source: http://www.entrepreneur.com/article/219917 Bookkeepers

Often considered by accountants and CPAs as just technicians or clerks, bookkeepers perform some of the same daily tasks as do accountants and certified public accountants. Many bookkeepers work as freelancers for small businesses in need of financial recordkeeping. Bookkeepers maintain daily accounting records, posting debits and credits, generating invoices for clients and checks for vendors as well as handling payroll. Many small business owners often double as bookkeepers. Bookkeepers typically lack the education of an accountant or CPA, as they gain on-the-job experience. Professional organizations for bookkeepers help to improve professional recognition for bookkeepers by accounting professionals as well as providing certification programs of abilities and skills. Accountants Accountants have a four-year college degree. While many accountants have an educational background in accounting, some are more general business majors. Companies that generate more than a million dollar in sales each year might have an accountant on staff or hire the services of a professional accountant from an accounting firm managed by a certified public accountant. As the company grows, the accounting department expands to handle the increased fiscal responsibilities within the organization. Accountants work with accounting clerks and technicians who handle daily financial entries. Accountants oversee or perform billing, make general ledger entries, review accounts payable activity completed by clerks or technicians or handle payroll. A mid-level position in the accounting department, accountants report to accounting managers, company controllers or financial directors, all of whom might be certified public accountants. Certified Public Accountants Certified public accountants have a focused education in accounting and must pass the Uniform Certified Public Accountant Examination. CPAs must meet state education and experience requirements before they can sit for the exam. Accountants not meeting these requirements cannot use the CPA designation legally. A CPA can work within a company or create his own company to offer accounting services to the public. Certification is renewable every two years, subject to state requirements. CPAs have a higher level of responsibility than bookkeepers or accountants; because of their certification, they perform auditing, tax and financial services for individuals, corporations and other business or nonprofit organizations. CPAs work with accountants and bookkeepers, auditing and overseeing financial records. Differences Though a bookkeeper might perform the same duties as an accountant, accountants and CPAs often do not consider bookkeepers as accounting professionals. But when a bookkeeper signs checks or handles payroll, she has the same liability as an accountant or a CPA with the same responsibilities under IRS law. In an accounting organization or department, duties are segregated to reduce fraud, errors or misappropriation of funds and to ensure strong financial control under generally accepted accounting principles. Working for a small organization, a bookkeeper might handle the duties of several jobs that would be segregated in an accounting or corporate environment. -Laurie Reeves What is business succession planning? Business succession planning refers to the practice of using estate planning strategies to increase the chances for the survival of your family business when you retire or die unexpectedly.

Original Source: http://wealthcounsel.com/articles/2015/business-success-planning-checklist?utm_content=buffer24eec&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer If your business has any employees, you’re not only responsible for issuing paychecks on a set schedule, but also for deducting and paying all applicable federal, state, and local income taxes to the government. Some people are intimidated by this responsibility, but the truth is that once you have a payroll system in place, it’s not that difficult to keep it running smoothly, especially with the help of your accountant. Here are the steps you should take to set up a system that will streamline the process.

Apply for an Employer Identification Number An Employer Identification Number (EIN) identifies you as a business entity that’s responsible for paying payroll taxes to the government. According to the IRS, if you have employees (not just independent contractors), you’ll need to apply for one. To do so, go to the IRS website and print out Form SS-4 [PDF] if you plan to submit it by mail or fax. If you are an international applicant, you can apply by phone. You can also complete and submit the form online. Learn Your State's Withholding Requirements In addition, some states require that you withhold state income tax, disability, or unemployment taxes from your employees' paychecks. Your state may require their own, separate, employer number and also an Account Number for unemployment purposes. The IRS offers a list of all state government offices where you can find your state’s requirements. Your accountant will be able to help with any questions or concerns you have with this process. Get the Required Paperwork from Employees You’ll need to have each of your employees fill out a Federal Income Tax Withholding form W-4 [PDF]. This will allow you to withhold the right amount of income tax from their paychecks. Decide How Often You’ll Pay Employees Next, you’ll need to decide how often to pay your employees. In addition to what’s convenient for you, you’ll need to adhere to your state's laws. (Every state has laws that determine how long you can go in between paychecks.) The typical pay schedule is every week, or every-other week. Choose Your System Next, you’ll need to decide which type of payroll system to use. Many business owners choose to calculate and record their payroll themselves manually. This option may seem lucrative, as it is the cheapest method, but it is also the most labor intensive and the most prone to error, leading to headaches during tax season and possible fines from the IRS. Using an online payroll service saves time and makes it easier to track important details such as employee hours, overtime, vacations, health care premium deductions and retirement contributions. In addition, the online system calculates the amount of the paycheck and tax withholdings, files the required tax forms, and pays your payroll taxes. If you’re like most small-business owners, time is your most valuable asset -- which is why many choose to completely outsource their payroll system to an accountant. Hiring an accountant to handle your payroll takes all calculations, reporting, and check issuing off of your plate and allows you to focus on other more pressing matters. Run the Payroll After you’ve set up your system, you’re ready to run payroll. If you use a desktop software program, you’ll have to enter the required information and print out the checks. If you choose an online payroll service, you simply enter the hours, and then either print the checks yourself or use the free direct-deposit feature. All that’s left is to report the payroll taxes to the appropriate tax agencies, paying them within the required time period. If you have chosen to outsource your payroll to an accountant, the process will run without you having to worry about it. All checks or direct-deposits will go out, plus all payroll taxes will be reported and paid within the required time period. |

|||||||

RSS Feed

RSS Feed