SWENSETH LAW

|

A comprehensive estate plan should include a Durable Power of Attorney, a Health Care Directive, and a blanket HIPAA release. HIPAA, the Health Insurance Portability and Accountability Act of 1996 created the health information privacy requirements for providers of health care services. HIPAA's privacy rules prohibit health care providers from sharing patients' private health information with anyone whom the patient has not authorized to receive such information.

A Health Care Directive appoints an Agent, and often alternative agents, to make decisions for the Principal. The Principal is the person granting the decision-making powers to an Agent. The Agent appointed in the Health Care Directive is generally considered to be authorized to receive the principal's private health information when the Principal is deemed not able to handle his/her own affairs. That makes sense. We wouldn't want your Agent making decisions without knowing the Principal's health care situation. That would be dangerous. Some people believe that the Agent doesn't have the right to receive the Principal's private health information until the Principal cannot speak for himself/herself. What would happen if the Principal is unable to speak for himself/herself because of a car accident or for some other sudden reason? That Principal needs health care decisions made in an emergency. Of course, emergency medical providers will provide the medical care necessary to deal with the emergency, but if the Principal has some non-obvious medical condition that the emergency personnel need to know? If the agent has not been able to receive the Principal's health information, then no one might be able to warn the emergency personnel about the Principal's condition. Your Agent might not be available in an emergency situation because the emergency personnel will probably not be able to look for the Agent (or even a Health Care Directive) while trying to attend to the Principal's emergency. Health care professionals won't withhold emergency treatment while looking for the Agent. That said, in the aftermath of the emergency, medical providers will want permission from the Principal or the Agent to provide follow-up care. This follow-up care will not be "emergency," but it may be pressing. Because of whatever created the need for emergency care (like a fall, an accident, or a stroke, for example,) the Principal may not be able to make a decision or may not be able to communicate his/her decision on health care matters. As a result, the Agent may need to make these decisions and, in some circumstances, may need to make these health care decisions quickly. When time is of the essence in a health care setting, the Principal's care should not be put on hold while the Agent learns for the first time about the Principal's potentially complicated health conditions. Think ahead about the possibility of such an emergency. Would you prefer to create a broad HIPAA release to allow the sharing of health information to your Agent and the alternative agents named in the Health Care Directive? It may be important to include additional family members, or close friends, that might be involved with and assisting the Agent at the time the Principal needs care.

2 Comments

For several years now Gun Trusts have gained in popularity, largely with firearms enthusiasts. With an ever increasing number of federal and state gun laws, many of which are unique and sometimes conflicting, and and an estimated 300 million firearms in the United States, it is certain that a firearm will be inherited or administered during incapacity of an owner. Gun Trusts are an answer to providing written guidance specific to possession and transfer of firearms to avoid potential criminal liability for getting these wrong.

Benefits of a Gun Trust. A gun trust can avoid some of the federal transfer requirements and accomplish other goals as well:

Making a Gun Trust. A gun trust is quite different from the common revocable living trust, which is used, like a will, to leave your assets at death. A simple living trust allows survivors to transfer trust assets without going through probate court, which saves time and money after your death. It generally terminates shortly after your death, when the trust assets have been distributed to the people who inherit them. A gun trust may have multiple trustees, be intended to last for more than one generation, and must take into account state and federal weapons laws. If you want to leave guns in trust, consult with a lawyer who has knowledge of the state and federal laws that govern who can legally use and possess weapons and how they must be transferred. What is the Generation Skipping Transfer Tax?

The federal generation skipping transfer (GST) tax is a tax on the transfer of property to a person who is two or more generations below the generation of the transferor. The transferor is the person who has transferred property to another, or to a trust for the benefit of another, in a manner that is subject to the gift or estate tax. The most common example of a GST is a gift or bequest from a grandparent to a grandchild. The GST tax is imposed on gifts a transferor makes during life or after death. It is applied separately from, and in addition to, the federal estate and gift taxes. Each US citizen receives an exemption for the GST tax that, in 2016, allows one to transfer $5.45 million of property during life or at death free from GST tax. This GST exemption amount, which increases each year with inflation, is allocated, either by election or automatically, to the transfers that may be subject to the GST tax. Generally, the GST tax is only a concern if a transferor will be giving more than the $5.45 million exemption amount away to grandchildren, trusts for grandchildren, or other people two or more generations younger than the transferor. What is the purpose of the Generation Skipping Transfer Tax? The transfer tax regime assumes that one generation will pass wealth to the next generation, which will then pass wealth to the next, without skipping a generation in between. In that way, as wealth gets passed from one generation to the next, it will be subject to a transfer tax (either estate or gift) at each generational level. However, before the implementation of the GST tax, wealthy individuals could circumvent the intergenerational taxation of assets. Savvy transferors who had enough wealth could leave a portion to a child and gift the balance it to future generations, either directly or in trust. This technique allows transferors to avoid the transfer tax that would have otherwise been imposed at each successive generation’s level. For example, if grandfather passes $100 million dollars to child, and child then passes $75 million of that inheritance to grandchild, the assets will be subject to the estate tax at both grandfather’s death and at child’s death. If grandfather passes $25 million to child and $75 million directly to grandchild, the $100 million will still be taxed at grandfather’s death. But, the $75 million that went to the grandchild will avoid another estate tax at child’s death. It will not be included in child’s estate since child never received it. If grandfather had chosen to put the assets in a trust for multiple generations of beneficiaries (known as a dynasty trust), the assets could pass for generations without ever again being subject to another transfer tax. The GST tax is effectively a 'backstop' tax that prevents a wealthy transferor from avoiding transfer taxes by skipping over generations of beneficiaries. With the GST tax, property that would otherwise be taxed only once at the transferor’s level will be taxed again when it passes to younger generations. Do I need to be concerned about the Generation Skipping Transfer Tax? When meeting with an attorney to discuss your estate planning goals, it is important that you are aware of and discuss the total value of your estate assets. To help our clients address this issue, Swenseth Law Office, works with estate planning clients to put together an Asset Value List to determine whether there are any possible GST tax issues and possible alternative planning options, while also creating a snapshot of your wealth and accounts to assist your personal representative and beneficiaries in the event of your death. To schedule an appointment to review your estate plan, call 701-662-5058. People often expect that an estate plan will provide for traditional assets like a home, jewelry, cash or bank accounts. Many people are unaware, however, of the extent of their digital assets created and used in daily life, as well as what happens to those digital assets upon death. More and more often, individuals rely on online accounts and own assets that may exist only on the Internet. These “digital assets” may include financial accounts, internet-based businesses, social media accounts, photographs, documents, and other digital files. Each of these assets may require a different username and password to access and manage.

What Are Digital Assets? “Digital assets” consist of any:

Some categories and examples of digital assets include:

Importance of Planning for Digital Assets There are several reasons why it is important to plan for digital assets. Proper planning may:

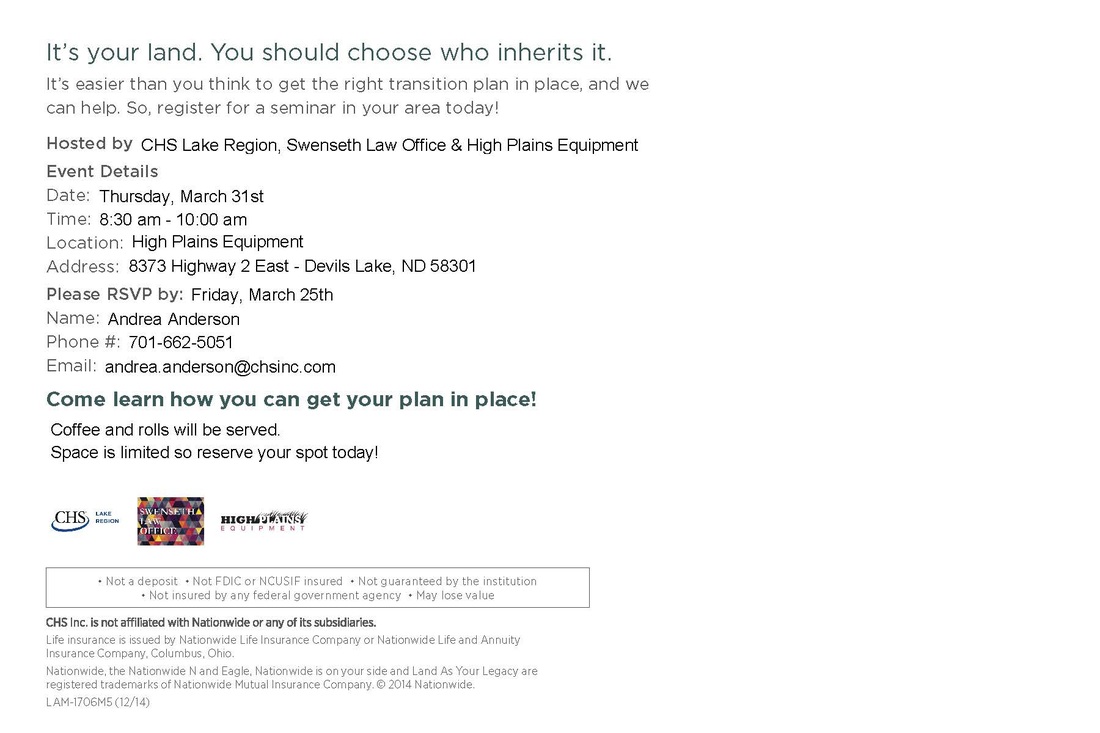

Although placing instructions in a power of attorney, will, trust or other freestanding document may not guarantee that your instructions will be followed, doing so would make it much more likely. Make clear in a power of attorney, will, trust or other document whether you would like for your fiduciaries to have management authority over digital assets or whether you would like to specifically withhold such authority. Options in Planning for Digital Assets Power of Attorney Instructions can be added to a financial power of attorney granting or withholding the authority to manage the online accounts and digital assets and access to the content of electronic communications. Will or Trust Instructions should be added to a will or trust granting or withholding from the personal representative or trustee the authority to manage digital assets and have access to the content of electronic communications. In addition, the disposition of digital assets may be provided for in the will or trust, either adding them as a specific bequest or simply including them in the list of personal effects given to a spouse or children. Some digital assets may not be transferable upon death, but some may be, so wishes regarding disposition should be made clear just in case those wishes can be followed. Grant Immediate Access Some service providers, such as Shutterfly and DropBox, specifically allow multiple individuals to have access. If you are willing to allow others to have access to some assets now, check your service provider's terms of service for this option. Swenseth Law Office is partnering with CHS, Nationwide, and e4 Brokerage to help our area farmers get started on their estate plan. Sign up to attend a seminar in Devils Lake at High Plains Equipment on March 31st to learn about common concerns and planning issues specific to farm families.

Single? Estate planning is still essential

By Matthew T. McClintock, J.D. Vice President, Education, WealthCounsel These days, more people are living single than ever before. In 1970, just about one- third of Americans 15 and older were single, according to U.S. census data. Today, that number’s closer to 50 percent. Whether never married, divorced or widowed, singles need to pay just as much attention to their estate planning as married folks, as highlighted in a recent Wall Street Journal article. Single people face unique estate planning issues that require advanced planning, time and the help of an experienced professional. Some of the most complicated estate planning issues for singles include: Heirs: When married people die without a will, their assets typically pass to their spouse. But what about single people? Assets are usually distributed along bloodlines, so children (if any), followed by parents, siblings or other relatives, would be the default heirs. If a single person has no living relatives, his or her assets might wind up with the state. To ensure their assets wind up with the relatives, loved ones and charitable organizations that they’d prefer, single people should create a will and/or an irrevocable trust that specifically states how they’d like their assets to be distributed. Decision makers: A health event or other incident could leave any of us incapacitated. For single people, it’s important to designate a trusted loved one or friend to manage assets and health care decisions in case of an emergency. Without proper directives, those decisions could fall to distant relatives or state-appointed strangers. Single people should sign a general power of attorney, an advance health care directive, and a HIPAA authorization allowing a loved one of choice to make financial and medical decisions on their behalf. Beneficiaries: Certain accounts, like retirement plans, require account holders to designate a beneficiary when they enroll. That beneficiary designation is typically upheld when the account holder dies, even if he or she gave the account to someone else in a will. Previously married or widowed singles should reevaluate all of their beneficiary designations to ensure accounts won’t be given to former spouses if that’s against their wishes. Those are just a few of the ways estate planning can be complicated for singles. It’s wise for single people to contact an estate planning professional as soon as possible, in order to make sure all their bases are covered and their assets are distributed according to their wishes. Original Source: http://www.estateplanning.com/Single-Estate-planning-is-still-essential/ EstatePlanning.com™ is a service provided by The WealthCounsel Companies, a nationwide collaborative of estate planning attorneys and wealth planning professionals who are dedicated to providing the best planning possible for American families.

Members of The WealthCounsel Companies are committed to client-centered estate planning and wealth management. This approach benefits you because it facilitates collaboration with your entire team of professional wealth advisors. That's why we encourage you to insure that all of your wealth planning professionals (attorney, insurance agent, financial advisor, CPA, etc.) are effectively communicating and working in unison to support your long-term planning goals. EstatePlanning.com provides you with objective, plain-English resources you need to answer your estate planning questions . . . and to help you better understand estate planning and the estate planning process. EstatePlanning.com can also connect you with an estate planning professional in your geographic area, if you’re so inclined. A common misperception is that estate planning is about planning for your death. Our goal with this service is to help Americans understand that estate planning is so much more. Estate planning is making a plan in advance and naming whom you want to receive the things you own after you die. Top 10 Reasons Why ALL Americans Need an Estate Plan

Original Source: http://www.estateplanning.com/about/ According to the Alzheimer's Association, dementia “is a general term for a decline in a person’s mental ability which is severe enough to interfere with daily life.” Dementia is not a specific disease, but rather refers to a wide range of memory decline or thinking skills which impacts daily life. Millions of Americans have some form of dementia, and millions of more Americans will develop some form of dementia as our population continues to age. Different types of dementia may progress at different paces, which makes it important to consider the topic of estate planning fairly quickly for persons prone to or in the early stages of dementia. Being diagnosed with dementia or having a loved one diagnosed with dementia can be a scary, confusing time. Families dealing with dementia often have many questions. If you or a loved one are dealing dementia, perhaps you have considered the questions below. Or, if you have not, the questions below may give you some food for thought as you begin to approach the topic of estate planning in the context of dementia.

1. I am concerned I may develop dementia based on my family history. When should I start to think about estate planning? If dementia is a concern for you, the time to plan is now. Watching a loved one or family member struggle with dementia can be a significant factor in driving individuals to prepare estate plans. Most people caring for loved ones with dementia want to make sure that future generations do not have to deal with the pressure of preserving and protecting assets on top of struggling with the grief and/or emotional turmoil of watching a family member battle dementia. Planning early will ensure that your wishes are clearly laid out, and that you have adequate plans in place to alleviate stress on future generations. 2. My doctor has told me I have dementia. Is it too late to create an estate plan? Often times, dementia is progressive, and individuals in the early stages of most forms of dementia still have the ability to make important decisions. Receiving a “diagnosis” of dementia does not necessarily mean that it is too late to create an estate plan. However, it is important to act quickly to make sure that you have sufficient time to outline your wishes and create an estate plan to provide for your needs. The sooner the estate planning process is completed, it is more likely that you will be able to exercise the control you would like over your estate plan, and more planning options and techniques will generally be available to you. Once dementia progresses to the point where you are no longer able to understand the nature and effect of creating an estate plan, it will be too late to preserve your wishes and desires. However, until that point, you are able to, and should, implement an estate plan. Depending on the type of dementia and its stage of progression, it may make sense to have a medical opinion outlining the ability to make estate planning decisions. 3. How does a person get appointed to act for me when my dementia progresses to the point I am no longer able to act for myself? If you have prepared an estate plan, the terms of the estate plan will outline how someone takes over for you. Most times, this transition can happen without probate court involvement. If you have not prepared an estate plan, it is likely that a family member or other interested person will seek to have a Guardian and/or Conservator appointed by the probate court to act on your behalf. In Michigan, Guardians are appointed for incapacitated persons to make decisions on the living arrangements, medical care, among other things, for the incapacitated person. Conservators are appointed to act as the financial and legal representatives of incapacitated persons. Both Guardians and Conservators are appointed by the probate court and both have ongoing reporting requirements to both the court and the family members or other persons interested in the well-being of the incapacitated person. 4. If I am concerned about dementia, what are the advantages of using a trust? The use of a trust may make sense for individuals facing dementia. However, as with all trusts, it is important to properly transfer all assets to the trust to avoid the necessity of probate, both during lifetime and at death. Your trust will likely contain a detailed plan for determining your incapacity and a detailed plan for use of the trust’s assets for your benefit during incapacity. Trusts maintain privacy and allow for greater flexibility in planning. If you are considering the use of a trust, you should seek both legal and tax advice to make sure your objectives are being met. 5. I don’t have long-term care insurance. How do I protect and preserve assets in light of increasing cost for long-term medical care? Planning to receive Medicaid benefits can be a difficult task. Medicaid eligibility follows strict guidelines, both in terms of the amount of assets you own and the amount of income you receive. Additionally, if you receive Medicaid benefits, the State of Michigan can attempt to recover for benefits paid on your behalf through the Medicaid estate recovery program. If you are likely to need Medicaid benefits in order to provide for your long-term care, you should seek legal advice to learn more about the qualification and reporting requirements associated with these benefits. 6. I own a business with other individuals. How will dementia affect my ownership of the business? Often, bylaws or operating agreements associated with a business outline how the business owners’ interests will be passed upon death or disability. Business owners should carefully review these provisions to ensure that they are fair and understood by all other owners. In the event changes need to be made, it is important to make those changes as soon as possible. Absent a provision in the business’ governing documents, the business interest may end up being managed by a person appointed under a Durable Power of Attorney or by a court-appointed Conservator, as the case may be. Often times, the remaining business owners are not comfortable with having a “new partner,” which can cause tension. Therefore, it is vitally important for the business documents to properly outline the agreements of the business owners. Original source: http://www.shrr.com/estate-planning-and-dementia-answers-to-common-questions  Despite their wealth and business savvy, more than one-third of high-net-worth families have not taken the most basic steps to protect and provide for their loved ones when they die, according to a recent survey by CNBC.com. The CNBC Millionaire Survey found 38 percent of those with investable assets of $1 million or more have not used a financial expert to establish an estate plan, while 62 percent have. Individuals with $5 million or more (68 percent) were more likely to do so, compared to those with $1 million to $5 million in assets (61 percent), according to the survey, conducted by Spectrem Group for CNBC, which polled 750 millionaires. Republicans (68 percent) were also more likely to use a financial advisor to establish an estate plan than Democrats (61 percent) or independents (58 percent). The numbers don't surprise Mitch Drossman, national director of wealth-planning strategies for U.S. Trust, who said the constant changes to the federal estate-tax law for nearly a decade (until it was made permanent in 2013) resulted in "estate-planning fatigue." "We have had an incredible amount of uncertainty with respect to estate taxes, and every change led advisors to reach out to their clients to explain these changes and be sure their documents were up to date and reflective of those changes," he said. "Clients finally said, 'Enough already.'" The higher federal estate-tax exemption amount, which now stands at $5.43 million per person due to annual inflation adjustments, has also rendered estate planning a lesser priority for many wealthy families, said David Mendels, a certified financial planner and director of planning for Creative Financial Concepts. Married couples can combine their exemptions to give away $10.86 million tax-free in 2015. "I think people tend to think of estate planning as being primarily a means to reduce estate taxes, and therefore, if they don't have to pay estate tax, they may feel they don't have to do any planning," said Mendels. But 15 states, including New York, Connecticut and Massachusetts, as well as the District of Columbia, levy their own estate taxes, which kick in at much lower thresholds. New Jersey's exemption, for example, is $675,000, Rhode Island's is $921,655, and Maryland's is $1 million. "Depending on where you live, estate taxes may still be a factor," said Mendels. Estate planning, however, is about much more than the size of one's taxable estate, he said. It's a series of documents that protect your assets, provide for your children and delineate your wishes regarding end-of-life decisions. Absent specific instructions, family members are left to guess at what you would have wanted, causing unnecessary stress and infighting. "Estate planning is not necessarily synonymous with tax planning," said Drossman at U.S. Trust. "There are still many valid reasons to do non-tax estate planning to address property management, to protect assets and to address exactly where you stand on issues you may confront later in life, like cognitive decline or disability. "That's going to be a bigger issue with longer life expectancies, better medical care and the aging population," he added. For families with minor children, a last will and testament is the most critical estate-planning document they can have, said Mendels at Creative Financial Concepts. "If you have young children, you need a will," he said. "It's not about the money. You need to name a guardian for your children, in case something happens to you and your spouse." It can also be used to set up trusts for any property your child will inherit and to name a trustee to handle the property until your child reaches the age you specify. Failure to do so means the courts would have to decide who is best suited to care for your children if tragedy should strike. A medical power of attorney is another important weapon in your estate-planning arsenal, authorizing an individual to make health-care decisions on your behalf in the event of physical injury or cognitive impairment. If you're married, that's typically your spouse, but if he or she dies first, you'll need a backup—ideally, someone who is geographically nearby who can communicate in person with your health-care providers, said estate-planning attorney and CFP Austin Frye, founder and president of Frye Financial Center. "If, God forbid, you are put in a situation from which you are not going to recover, you want to keep control over what happens to you," said Frye. Such documents are often created alongside an advanced medical directive for physicians, also called a living will, which clarify your wishes regarding end-of-life medical treatment, including resuscitation and organ donation. (Make sure you have a HIPAA form attached, which grants your power of attorney the right to access your medical records, which are protected under privacy laws.) A durable financial power of attorney document is also necessary, as it identifies the person you'd like to manage your money if you are unable to make decisions for yourself, said Frye. Such legal documents grant that person legal authority to pay taxes on your behalf, borrow money, pay your bills, invest and handle bank transactions. With higher income-tax rates in effect, tools and techniques that help minimize the income-tax hit to your estate—and your heirs—are playing a far bigger role in estate planning today, said Mendels at Creative Financial Concepts. To learn more about how we use your information, please read our Privacy Policy. Indeed, the top marginal tax rate for wealthy taxpayers now stands at 39.6 percent. Those with higher incomes also face a higher capital gains rate of 20 percent instead of 15 percent, a 0.9 percent tax on earned income (wages) and a 3.8 percent Medicare surtax on net investment income, plus the phaseout of personal exemptions and deductions. "As estate taxes have come down, the income-tax consequences are much more important," said Mendels. For example, trusts remain a valuable tool for protecting assets from creditors, legal claims and offspring with poor money-management skills, but due to recent tax-law changes, they could also leave your heirs with less. Effective in 2013, trusts that accumulate income are now hit with the 3.8 percent Obamacare tax that applies to net investment income. The beneficiaries are also subject to the highest income-tax rate of 39.6 percent and the top capital gains rate of 20 percent on any income received from the trust in excess of $12,150. By comparison, the top income-tax rate for individual taxpayers kicks in at $400,000 for single filers and $450,000 for married couples filing jointly. "Trusts are very versatile, and they can do a lot of things, but these are things that need to be thought through," said Mendels. "Your heirs may end up paying much more income tax by leaving property to them in trust than if you just gave it to them outright." Drossman at U.S. Trust said income-tax implications, as a component of estate planning, have taken center stage at his firm, too. That, and what he calls "reverse estate planning." "In some cases we're helping clients unwind or reverse some of the estate planning they had done in the past, because it may no longer be needed, given the significant estate-tax exemption or because it would add to their income-tax cost," he said. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos."-Austin Frye, founder and president of Frye Financial CenterSome families, for example, are taking assets out of trust and giving them outright to their heirs, since they now fall below the estate-tax exemption line. Others created LLCs or family partnerships years ago to facilitate a discounting of assets, but new rules in some cases prevent assets held in such structures to take full of advantage of the step-up in basis. Remember: Those who inherit appreciated property, including real estate and stocks, receive a step-up in cost basis for tax purposes based on the current market value on the date of the benefactor's death. Thus, the beneficiary could sell the property immediately without incurring a capital gain, or sell it years from now and only owe gains based on its price appreciation from the day they inherited it. "If held in a discounted entity, they're not stepped up as high as they would have been had they been held outside that entity," said Drossman. "They may no longer want that in place if they don't benefit from any estate-tax savings, and they get a lower basis." It's never pleasant to contemplate one's own mortality. But high-net-worth families who fail to plan—and there are many—risk exposing their kids' inheritance to creditors, predators and bitter ex-spouses. Worse, they leave life's most important decisions—such as who will care for their kids and whether their spouse should pull the plug—in the hands of the courts. "You have to plan for the worst and hope for the best," said Frye of Frye Financial Center. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos." —By Shelly Schwartz, special to CNBC.com Initiating a conversation regarding estate planning can be difficult. Make it easier with these tips courtesy of NDSU Extension. https://www.ag.ndsu.edu/pubs/yf/famsci/fs1684.pdf |

RSS Feed

RSS Feed