SWENSETH LAW

|

What is the Generation Skipping Transfer Tax?

The federal generation skipping transfer (GST) tax is a tax on the transfer of property to a person who is two or more generations below the generation of the transferor. The transferor is the person who has transferred property to another, or to a trust for the benefit of another, in a manner that is subject to the gift or estate tax. The most common example of a GST is a gift or bequest from a grandparent to a grandchild. The GST tax is imposed on gifts a transferor makes during life or after death. It is applied separately from, and in addition to, the federal estate and gift taxes. Each US citizen receives an exemption for the GST tax that, in 2016, allows one to transfer $5.45 million of property during life or at death free from GST tax. This GST exemption amount, which increases each year with inflation, is allocated, either by election or automatically, to the transfers that may be subject to the GST tax. Generally, the GST tax is only a concern if a transferor will be giving more than the $5.45 million exemption amount away to grandchildren, trusts for grandchildren, or other people two or more generations younger than the transferor. What is the purpose of the Generation Skipping Transfer Tax? The transfer tax regime assumes that one generation will pass wealth to the next generation, which will then pass wealth to the next, without skipping a generation in between. In that way, as wealth gets passed from one generation to the next, it will be subject to a transfer tax (either estate or gift) at each generational level. However, before the implementation of the GST tax, wealthy individuals could circumvent the intergenerational taxation of assets. Savvy transferors who had enough wealth could leave a portion to a child and gift the balance it to future generations, either directly or in trust. This technique allows transferors to avoid the transfer tax that would have otherwise been imposed at each successive generation’s level. For example, if grandfather passes $100 million dollars to child, and child then passes $75 million of that inheritance to grandchild, the assets will be subject to the estate tax at both grandfather’s death and at child’s death. If grandfather passes $25 million to child and $75 million directly to grandchild, the $100 million will still be taxed at grandfather’s death. But, the $75 million that went to the grandchild will avoid another estate tax at child’s death. It will not be included in child’s estate since child never received it. If grandfather had chosen to put the assets in a trust for multiple generations of beneficiaries (known as a dynasty trust), the assets could pass for generations without ever again being subject to another transfer tax. The GST tax is effectively a 'backstop' tax that prevents a wealthy transferor from avoiding transfer taxes by skipping over generations of beneficiaries. With the GST tax, property that would otherwise be taxed only once at the transferor’s level will be taxed again when it passes to younger generations. Do I need to be concerned about the Generation Skipping Transfer Tax? When meeting with an attorney to discuss your estate planning goals, it is important that you are aware of and discuss the total value of your estate assets. To help our clients address this issue, Swenseth Law Office, works with estate planning clients to put together an Asset Value List to determine whether there are any possible GST tax issues and possible alternative planning options, while also creating a snapshot of your wealth and accounts to assist your personal representative and beneficiaries in the event of your death. To schedule an appointment to review your estate plan, call 701-662-5058.

7 Comments

Swenseth Law Office is partnering with CHS, Nationwide, and e4 Brokerage to help our area farmers get started on their estate plan. Sign up to attend a seminar in Devils Lake at High Plains Equipment on March 31st to learn about common concerns and planning issues specific to farm families.

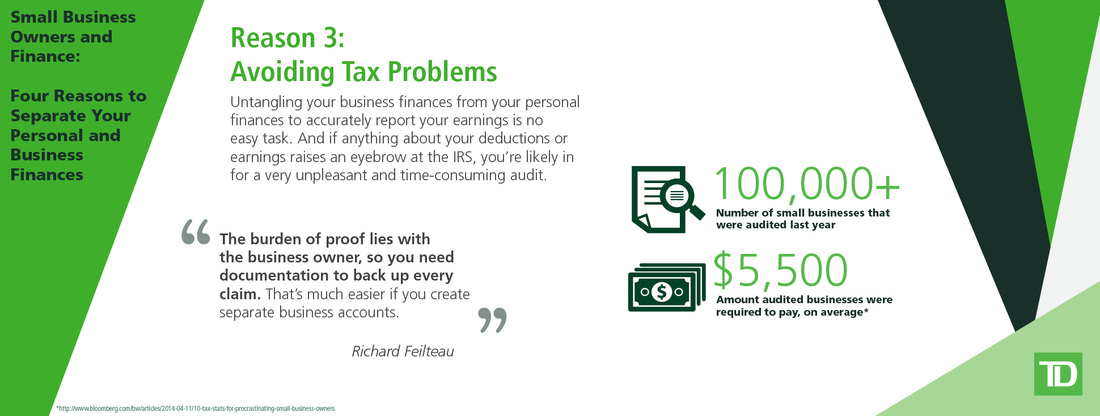

Keeping your financial records in order is hugely important to the success of your business. Not only does it keep you up-to-date on your profits and losses, but legally speaking, it’s necessary to have your records straight. It makes the close of your fiscal year easy to execute by ensuring that all of your required statements are in the right place. This is especially important for dealing with the IRS.

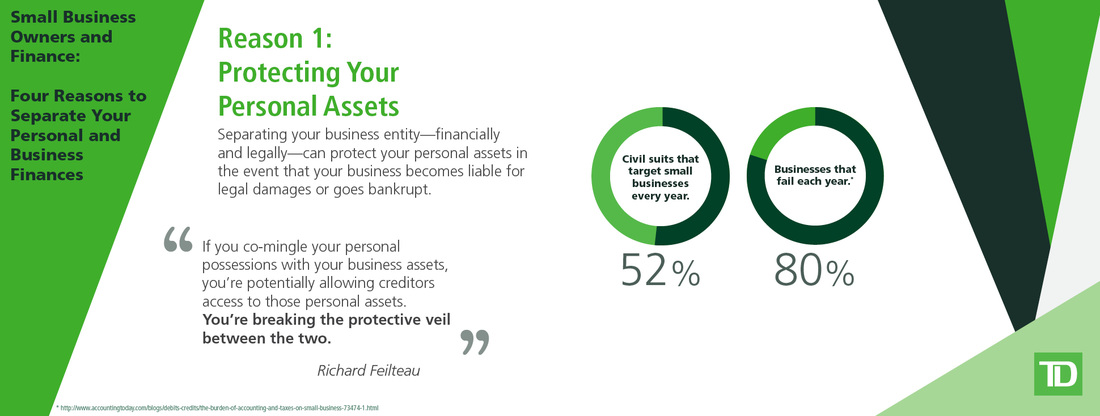

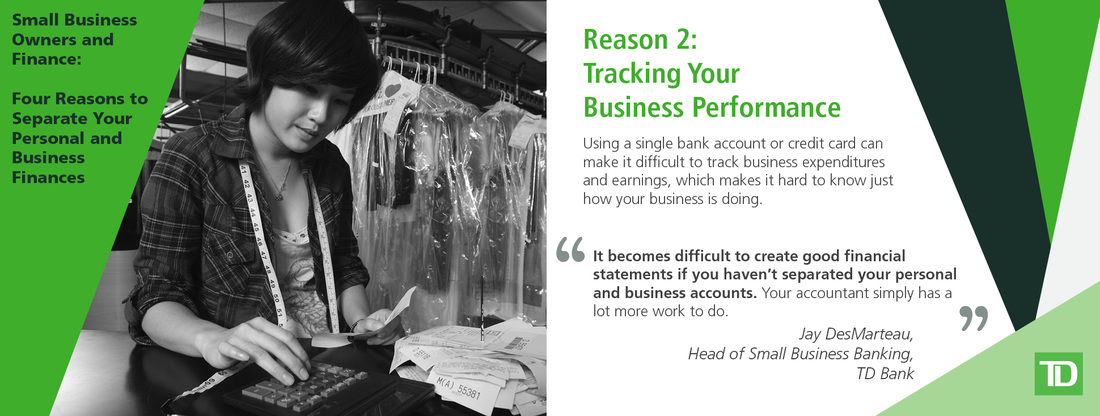

Understanding just what exactly goes into a fiscal year close can be confusing, however, especially for new small business owners. Even if you have an accountant on staff or retainer, it’s still important to keep track of your finances yourself. It just makes good business sense for you, as the owner, to understand what exactly is happening with your money. Let’s examine the steps you should take when closing out your small business’ books for the end of the fiscal year. 1. Review your profit and loss statements Your business' profit and loss statements will help you get a snapshot of its financial performance. What does your revenue look like now that the year is almost through? Do you anticipate any other large expenses to hit your books? If not, evaluate how much money you have available, and see if it might be wise to make a larger purchase before the end of the year so that the item can depreciate. 2. Verify Your Vendor and Lender Files It’s important to review the paperwork—including 1099s—associated with any of your vendors, as well as information relating to any current outstanding loans. Make sure all of your vendor 1099 forms are up-to-date and accurate. You also want to make sure the 1099 information has been inputted correctly into youraccounting system so that it’ll populate the forms when printed. 3. Take Inventory If you sell products, conduct an inventory assessment and compare the results to your last inventory report. Make any necessary adjustments so that you have an accurate account of how much capital you have wrapped up in your current inventory. Even if you don’t sell products, it’s not a bad idea to take an inventory of elements in your office, such as equipment, computers, office supplies, etc. Make a list of any broken equipment or equipment in need of repair. If you lease any electronics, such as copiers, pull out the contract associated with it and make sure the terms are still appropriate for your situation. 4. Look for Benefits to Report on Your Outgoing W-2 As a business that issues W-2s, these benefits relate to the organization as a whole and can reflect things such as health and life insurance, transportation subsidies, educational reimbursement programs and more. 5. Create a Budget for the Following Year It’s never too early to plan. By reviewing your statements from the current year, you’ll start to see a pattern in the things you need to budget and plan for in the next year. By taking stock of your expenditures from the current year, you’ll have a better understanding of where to focus your efforts moving forward. Original Source Four Reasons Small Business Owners Should Consider Separating Personal and Business Finances10/30/2015 If you're a business owner who is co-mingling your finances, you're not alone. But this practice is risky, causing problems at both the operational and the fiscal level. original source:

You’ve worked hard to build your business and you’re thinking, what’s next? If selling your business is in your future, know that preparing for a successful sale can be a long-term process. To maximize the value of your business, you’ll need to plan and prepare well in advance. The attached PDF by Dan Wright provides a guide to preparation.

Original Source: http://www.leadingedgealliance.com/thought_leadership/10%20Must-DosBeforeSellingBusinessCLARKNUBER.pdf When doing any kind of work, it’s important to have a contract. Sure, it may seem a bit daunting for a beginning entrepreneur to delve into legalese, but contracts don’t need to be scary. They can be as simple as a plain-language document that outlines the general business between you and the client. In the world of small business, they’re important for the following reasons:

Never feel awkward about insisting a client works with a contract. It’s a mark of professionalism and should actually inspire confidence, knowing that you take your business seriously. Any client who refuses to work with one should be treated suspiciously as that’s a serious red flag. And any small business owner who works without at least having something in writing, whether it be a formal document or just confirming emails, is destined for some serious heartache later down the road. Original source: http://businessofillustration.com/the-importance-of-contracts/  Despite their wealth and business savvy, more than one-third of high-net-worth families have not taken the most basic steps to protect and provide for their loved ones when they die, according to a recent survey by CNBC.com. The CNBC Millionaire Survey found 38 percent of those with investable assets of $1 million or more have not used a financial expert to establish an estate plan, while 62 percent have. Individuals with $5 million or more (68 percent) were more likely to do so, compared to those with $1 million to $5 million in assets (61 percent), according to the survey, conducted by Spectrem Group for CNBC, which polled 750 millionaires. Republicans (68 percent) were also more likely to use a financial advisor to establish an estate plan than Democrats (61 percent) or independents (58 percent). The numbers don't surprise Mitch Drossman, national director of wealth-planning strategies for U.S. Trust, who said the constant changes to the federal estate-tax law for nearly a decade (until it was made permanent in 2013) resulted in "estate-planning fatigue." "We have had an incredible amount of uncertainty with respect to estate taxes, and every change led advisors to reach out to their clients to explain these changes and be sure their documents were up to date and reflective of those changes," he said. "Clients finally said, 'Enough already.'" The higher federal estate-tax exemption amount, which now stands at $5.43 million per person due to annual inflation adjustments, has also rendered estate planning a lesser priority for many wealthy families, said David Mendels, a certified financial planner and director of planning for Creative Financial Concepts. Married couples can combine their exemptions to give away $10.86 million tax-free in 2015. "I think people tend to think of estate planning as being primarily a means to reduce estate taxes, and therefore, if they don't have to pay estate tax, they may feel they don't have to do any planning," said Mendels. But 15 states, including New York, Connecticut and Massachusetts, as well as the District of Columbia, levy their own estate taxes, which kick in at much lower thresholds. New Jersey's exemption, for example, is $675,000, Rhode Island's is $921,655, and Maryland's is $1 million. "Depending on where you live, estate taxes may still be a factor," said Mendels. Estate planning, however, is about much more than the size of one's taxable estate, he said. It's a series of documents that protect your assets, provide for your children and delineate your wishes regarding end-of-life decisions. Absent specific instructions, family members are left to guess at what you would have wanted, causing unnecessary stress and infighting. "Estate planning is not necessarily synonymous with tax planning," said Drossman at U.S. Trust. "There are still many valid reasons to do non-tax estate planning to address property management, to protect assets and to address exactly where you stand on issues you may confront later in life, like cognitive decline or disability. "That's going to be a bigger issue with longer life expectancies, better medical care and the aging population," he added. For families with minor children, a last will and testament is the most critical estate-planning document they can have, said Mendels at Creative Financial Concepts. "If you have young children, you need a will," he said. "It's not about the money. You need to name a guardian for your children, in case something happens to you and your spouse." It can also be used to set up trusts for any property your child will inherit and to name a trustee to handle the property until your child reaches the age you specify. Failure to do so means the courts would have to decide who is best suited to care for your children if tragedy should strike. A medical power of attorney is another important weapon in your estate-planning arsenal, authorizing an individual to make health-care decisions on your behalf in the event of physical injury or cognitive impairment. If you're married, that's typically your spouse, but if he or she dies first, you'll need a backup—ideally, someone who is geographically nearby who can communicate in person with your health-care providers, said estate-planning attorney and CFP Austin Frye, founder and president of Frye Financial Center. "If, God forbid, you are put in a situation from which you are not going to recover, you want to keep control over what happens to you," said Frye. Such documents are often created alongside an advanced medical directive for physicians, also called a living will, which clarify your wishes regarding end-of-life medical treatment, including resuscitation and organ donation. (Make sure you have a HIPAA form attached, which grants your power of attorney the right to access your medical records, which are protected under privacy laws.) A durable financial power of attorney document is also necessary, as it identifies the person you'd like to manage your money if you are unable to make decisions for yourself, said Frye. Such legal documents grant that person legal authority to pay taxes on your behalf, borrow money, pay your bills, invest and handle bank transactions. With higher income-tax rates in effect, tools and techniques that help minimize the income-tax hit to your estate—and your heirs—are playing a far bigger role in estate planning today, said Mendels at Creative Financial Concepts. To learn more about how we use your information, please read our Privacy Policy. Indeed, the top marginal tax rate for wealthy taxpayers now stands at 39.6 percent. Those with higher incomes also face a higher capital gains rate of 20 percent instead of 15 percent, a 0.9 percent tax on earned income (wages) and a 3.8 percent Medicare surtax on net investment income, plus the phaseout of personal exemptions and deductions. "As estate taxes have come down, the income-tax consequences are much more important," said Mendels. For example, trusts remain a valuable tool for protecting assets from creditors, legal claims and offspring with poor money-management skills, but due to recent tax-law changes, they could also leave your heirs with less. Effective in 2013, trusts that accumulate income are now hit with the 3.8 percent Obamacare tax that applies to net investment income. The beneficiaries are also subject to the highest income-tax rate of 39.6 percent and the top capital gains rate of 20 percent on any income received from the trust in excess of $12,150. By comparison, the top income-tax rate for individual taxpayers kicks in at $400,000 for single filers and $450,000 for married couples filing jointly. "Trusts are very versatile, and they can do a lot of things, but these are things that need to be thought through," said Mendels. "Your heirs may end up paying much more income tax by leaving property to them in trust than if you just gave it to them outright." Drossman at U.S. Trust said income-tax implications, as a component of estate planning, have taken center stage at his firm, too. That, and what he calls "reverse estate planning." "In some cases we're helping clients unwind or reverse some of the estate planning they had done in the past, because it may no longer be needed, given the significant estate-tax exemption or because it would add to their income-tax cost," he said. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos."-Austin Frye, founder and president of Frye Financial CenterSome families, for example, are taking assets out of trust and giving them outright to their heirs, since they now fall below the estate-tax exemption line. Others created LLCs or family partnerships years ago to facilitate a discounting of assets, but new rules in some cases prevent assets held in such structures to take full of advantage of the step-up in basis. Remember: Those who inherit appreciated property, including real estate and stocks, receive a step-up in cost basis for tax purposes based on the current market value on the date of the benefactor's death. Thus, the beneficiary could sell the property immediately without incurring a capital gain, or sell it years from now and only owe gains based on its price appreciation from the day they inherited it. "If held in a discounted entity, they're not stepped up as high as they would have been had they been held outside that entity," said Drossman. "They may no longer want that in place if they don't benefit from any estate-tax savings, and they get a lower basis." It's never pleasant to contemplate one's own mortality. But high-net-worth families who fail to plan—and there are many—risk exposing their kids' inheritance to creditors, predators and bitter ex-spouses. Worse, they leave life's most important decisions—such as who will care for their kids and whether their spouse should pull the plug—in the hands of the courts. "You have to plan for the worst and hope for the best," said Frye of Frye Financial Center. "The probability of something happening may not be high, but if it does and you haven't planned, anything is possible, including litigation, higher taxes and complete chaos." —By Shelly Schwartz, special to CNBC.com The following material is provided for informational purposes only. Before taking any action that could have legal or other important consequences, speak with a qualified professional who can provide guidance that considers your own unique circumstances.

A well written and signed contract with your client can be the cornerstone of a successful and claims-free project. Yet it is surprising how many design firms continue to start new projects with simply a verbal agreement and hearty handshake. Architects and engineers give many reasons why they forego the formality of a written contract before starting their design services. These include:

The overriding assumption behind this reasoning is that a written contract is unnecessary because, chances are, nothing serious will go wrong with the project. And if something does go wrong, the parties will set things right. Sometimes a designer and client can indeed iron out a project upset with a quick conversation and a handshake. But rarely does that happen when there is a lot of money at stake. All of a sudden, that trusted client isn’t quite so amicable and he or she doesn’t remember that verbal agreement quite the same way as you do. Verbal Agreements Are Binding “A verbal agreement ain't worth the paper it’s printed on,” Louis B. Meyer is supposed to have advised. Still, from a legal perspective, a verbal agreement in lieu of a written contract is generally binding. When you reach a verbal agreement with a client and start to perform services, you are both acting as though a contract is in effect. Therefore, in the eyes of the law, a binding agreement is in effect. The verbal agreement, no matter how brief, is a contract. But what happens if something goes wrong with the project? In that case, you and your client will explain your respective understandings of what was agreed to. Not surprisingly, those understandings often differ. So while the verbal agreement is binding, the two parties are often in disagreement as to what each party is bound to do. Who determines what each party to the verbal contract really said and meant? That responsibility typically falls to a trier of fact – a judge, jury, arbiter or mediator. Unfortunately, the trier of fact was not there to hear the verbal agreement, so they have the difficult task of making a ruling based on differing testimonies of the two parties. And in the case of a jury trial, the trier of fact likely does not fully understanding the types of services you render or the prevailing standard of care you must meet when delivering those design services. One instance where a verbal agreement may not be held binding is when a written contract covering the same project is later drafted and signed. In such instances, the written contract now overrides the original verbal agreement. Asking for a Written Contract So how does a design firm instill the formality of a detailed written contract with a client who is used to a simple discussion and firm handshake? This shouldn’t be too difficult considering that a clearly written contract is extremely beneficial to both parties to the agreement. Consider this scenario: You meet with a repeat client you’ve known for years to discuss a new project. The client immediately begins discussing the design services needed and doodling a quick drawing on a napkin. You pull out your notepad and begin recording the client’s explanation of the project. “I’ll tell you what, Bill,” you say. “I think we would both greatly benefit if we documented this agreement in a formal written contract. I know we’ve worked off of a handshake before, and I trust you fully. But with a written contract, we can make sure we both have a full and mutual understanding of your wants and needs. It will help us avoid any misunderstandings, like that HVAC snafu we had on your warehouse project on Second Street. I want to make sure you’re completely happy on this new project and that I fully understand what you want. “You know, Bill, I don't like the time and expense involved with these written contracts any more than you do. But I sure as heck would rather have you and I determine our fate rather than a bunch of expensive lawyers and folks who don't know us from Adam. A written agreement will help us make sure that should a dispute arise, it will be settled in accordance with the facts we agreed to, not the opinion of some outsider.” If your client continues to balk about signing a formal written agreement before the project commences, reiterate that a contract is simply a tool to help avoid misunderstandings and resulting problems. Try to allay any fears that the contract is somehow a trap to be used against the client in the event of a dispute. “Bill, don't look at a written contract as a weapon to hold over someone’s head,” you can explain. “See it as a confirmation of the terms and services we have agreed to. When it comes to what your project needs relative to my services, we will need to discuss a lot of issues to make things right, and we need to keep track of what it is we discussed. If we don't record what we talked about, one of us – or both of us – stand the risk of being in for an unpleasant surprise. I don’t know about you, but I can’t promise that I will remember everything said in our discussions. Understandings differ and memories can fade. By putting our agreement in writing, we can have a true meeting of the minds, based on what we see as the best road ahead. “As we start down that road, we may run into a few unexpected bumps, potholes, curves or detours. We’ll talk about it and do our best to resolve problems – just like we always have. You want your project done right and I want to keep you as a valued client. The contract is a great roadmap to get there.” Don’t Forget Third Parties Another important reason for a written agreement is the ability to prevent third parties, such as a contractor or a tenant, from gaining the standing they need to sue you and/or your client based on a contention that they are third-party beneficiaries of your agreement. If your agreement with your client is verbal, the third party may enjoy an advantage. Juries are often sympathetic to third parties, especially those with whom they can readily identify as “the little guy.” Your written agreement with a client can address unauthorized third-party reliance, and can be attached to appropriate deliverables (such as reports) to help ensure any third party reviewing them understands the contractual limitations (scope, schedule, fee, general conditions) affecting them. A verbal agreement contains no such limitations and is difficult to defend. One More Argument for a Written Contract You may point out to your client that, if anything happens to either of you, or one of the parties to the verbal agreement leaves his or her firm, the project will be affected, problems will be likely, dollars will be involved and disputes will arise. Explain, “A written contract will tell others what we intended to do. They won’t know about our verbal understandings. They need that guidance in writing.” Is It Insurable? Suppose you and your client enter into a verbal agreement and later have a dispute you can’t resolve. You go before a judge or jury who, based solely on your verbal testimonies, issues a judgment in your client’s favor. Your client should be happy, right? Well not necessarily. Suppose the wording of the judgment, written by someone not well versed in laws and standards governing the design and construction industry, is perceived by your insurer as an uninsurable liability. Your client won the battle, but he or she may have just lost the war. Unless your firm can cover the damages, the client may have just lost your services and jeopardized the project from a financial standpoint. Tell your client: “Bill, I have a great insurance company, solid coverage and a fantastic agent. She can help us review our written agreement and assist us in making sure that it’s insurable. This benefits you as much as me. An uninsurable agreement, verbal or otherwise, doesn’t do either of us any good.” Short Is Not Always So Sweet Some clients will grudgingly agree to use a purchase order, proposal or similar “short-form” contract, but they remain averse to long agreements that require more time to draft and review. The problem is that short-form agreements are, by nature, silent on a number of important issues. Once again, outside triers of fact are asked to resolve disputes without the benefit of a comprehensive written agreement. Tell your client who only wants to offer a purchase order: “Bill, what is the harm of having a long contract rather than a short one? A long one serves to cover a broad range of important issues. As long as the contract is well written in reasonably understandable terms, what is the drawback? Some detail in our agreement might be relevant to a pressing issue, and we’ll be glad we took the time to address it. And if the issue doesn’t come up, no harm, no foul.” You might also add: “A big advantage to drafting and reviewing a thorough contract is that it allows us to discuss the ‘what-ifs’ and address potential solutions. The more we know about the project and reach agreement on various issues, the more we set out what we expect from one another. That’s not a bad thing.” If you provide repeat services to a contract-adverse client, consider using a continuing service or “master” agreement. This document sets general terms and conditions that apply to all of the projects conducted over a particular period of time. Then you can develop just the scope, schedule and fees for each individual project. Your professional association may offer standard forms for these master agreements. True Value Arguably, the greatest value of drafting a comprehensive contract comes not from the words that go onto the paper, but from the process through which important issues are identified and discussed. The client gains a better understanding of project risks and what the two of you can do to manage them. The client also learns what the both of you can do to lower the likelihood of errors or omissions. And you can both set up a framework in which any problems that do arise can be addressed in a fair and equitable manner that focuses on problem resolution rather than finger-pointing and disagreement as to what you had verbally agreed to. The contract-formation process, more than any other aspect of your project involvement, gives you the opportunity to demonstrate your professionalism and generate the communication, coordination and cooperation required for project success. And that’s something every client can give a thumb's up to. Finally, if a client continues to refuse to enter into written agreements perhaps this isn’t the type of client you should be doing business with. A client who will not commit to fees, schedules and other commitments in writing may not intend to live up to those commitments. Original source: http://www.camillericlarke.com/ArchitectEngineerNews/newsView.asp?NewsId=4096856 Initiating a conversation regarding estate planning can be difficult. Make it easier with these tips courtesy of NDSU Extension. https://www.ag.ndsu.edu/pubs/yf/famsci/fs1684.pdf What is business succession planning? Business succession planning refers to the practice of using estate planning strategies to increase the chances for the survival of your family business when you retire or die unexpectedly.

Original Source: http://wealthcounsel.com/articles/2015/business-success-planning-checklist?utm_content=buffer24eec&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer |

|||||||

RSS Feed

RSS Feed